Welfare and Regional Integration Agreements: Lessons for Africa

In the developing world, regional integration is frequently seen as an opportunity to promote development. However, historical facts and economic literature remind us that the success of economic integration is not always guaranteed, and numerous considerations should be taken into account in designing such agreements. This short paper considers the broad reasons for countries forming regional integration agreements, including strengthening trade relations, improving investments, boosting economic performance, and finally, enhancing foreign relations. It also explores the travails of the multilateral trading system and then considers the differences between Customs Unions and Free Trade Areas. Finally, it analyzes the approaches used to evaluate the basic economic impacts of agreements.

Assessing Proposals for Regional Integration Agreements (RIAs)

1. Introduction

Trade in goods and services is providing more and more opportunities for developing countries. In manufacturing and services, modern communications allow producers to break the production process into stages—and to distribute them across countries in a way scarcely imaginable a generation ago (Baldwin, 2016). In agriculture, the enormous differences between countries in their agricultural resources, and the rise of trade in horticultural and processed products, create many opportunities for producers.

Taking full advantage of these opportunities requires countries to reform both trade and investment policies in ways that facilitate trade. Breaking up the production chain in manufactures and services requires much more trade than was previously needed, because it involves trade in intermediate inputs—possibly multiple times, depending on the degree of fragmentation of the production process—as well as final products. This process requires not just openness to trade, but also receptiveness to foreign investment, since foreign investors are frequently able to bring new approaches that raise productivity and incomes.

In the 1980s and early 1990s, it looked as though the multilateral trading system (the GATT/WTO) might be able to deliver the reforms needed to take advantage of these new trading opportunities. However, as the Uruguay Round negotiations (1986-2004) dragged on, many countries began negotiating regional trade agreements and the number of new agreements reported to the WTO (see Figure 1) soared. While the rate at which new agreements have been introduced has declined from its peak in the early 2000s, the number of agreements in force has continued to grow. The total number of agreements in force has risen from less than 100 in the early 1990s to 455 in 2018.

The WTO requires a consensus before adoption of any policy change. While this principle protects smaller and more vulnerable countries from changes with which they disagree, it also limits the rate and depth of change that can be achieved. A smaller group of countries may be able to reach agreement about issues on which they agree are important to them, but on which an agreement could not be reached at the multilateral level. If creating value chains that allow each country to participate in a successful export platform is important to them, they might, for instance, go deeper than the WTO in terms of protecting the rights of investors. In this way, bilateral and regional trade agreements are potentially useful complements to the multilateral trading system for strengthening economic and political cooperation between states, and improving economic performance.

Figure 1. Evolution of Regional Trade Agreements in the World, 1948-2018

In the developing world, regional integration is frequently seen as having potential to promote development. However, history and economic literature remind us that the success of economic integration is not guaranteed, and much needs to be considered in designing such agreements . A key problem is that there is no guarantee that a partial move to trade liberalization, such as liberalizing against imports from partner countries but not imports from other countries, will increase economic welfare. As first pointed out by Jacob Viner (1950), the key in determining whether an FTA, or other regional integration agreement, will improve economic welfare is by assessing whether the benefits it generates through trade creation will exceed the costs resulting from trade diversion. This policy note aims to provide some guidelines to help in deciding whether a proposed agreement might have favorable implications for development.

In the next section of the paper, we consider the broad goals that policy makers might seek to achieve through creating regional arrangements. In Section 3, we compare FTAs with alternatives such as Customs Unions. In section 4, we discuss some of the fundamental economic approaches to evaluating the economic benefits, or costs, involved in joining an FTA.

2. Goals of Regional Integration Agreements (RIAs)

Governments considering joining RIAs may have several different goals that guide them in deciding whether to join an agreement and in the selection of partners. We group them into four categories: to strengthen trade relations, to promote investment, to improve economic performance, and to improve foreign relations.

2.1. Strengthening Trade Relations

A key instrument in forming an RIA is reductions in trade barriers between partner countries. WTO rules on regional integration (WTO 1995) require that substantially all trade between partners be liberalized (WTO 1995) so it is useful to think of complete elimination of the barriers between partner countries as a benchmark against which the effects of any exceptions might be considered.

Liberalization between partners can be expected to increase the number and the quantity of goods traded between them. Access to partners’ markets raises export prices and allows increased exports. The abolition of protection on imports within the RIA lowers the prices of imported goods and increases imports from partners. The liberalization of their own barriers generally provides economic benefits to the countries undertaking the liberalization. In addition, countries joining regional trade agreements gain from improved access to partner markets—a gain which is not available to them when they liberalize unilaterally.

Unfortunately, as first pointed out by Viner (1950), liberalization on imports from partners may create trade diversion by replacing imports from low-cost non-partners with imports from potentially higher-cost partner countries. The combination of gains from liberalization with losses from trade diversion means that regional trade agreements need to be evaluated carefully. In contrast with the textbook case of small, open economies that liberalize relative to all their partners, discriminatory liberalization under an RIA will not necessarily lead to an improvement in welfare.

Another important difference between unilateral reform and an international trade agreement is that an agreement may allow a country to make a credible commitment to maintaining future trade openness. While this commitment effect may sound esoteric, the experience of China’s accession to the WTO provides evidence that it can be very important. Prior to China’s accession, the United States allowed imports from China to enter at its so-called Most-Favored Nation (MFN) tariffs, but only on an annually-renewable basis. Following accession, applied tariffs did not change, but it became highly unlikely—until the Trump Administration—that the United States would raise its tariffs on imports from China above the MFN level. Handley and Limão (2017) conclude that the resulting reduction in uncertainty about future trade barriers explained one third of the near-trebling of Chinese exports to the USA between 2000 and 2005. Clearly, however, the gains from such commitments depend upon the ability and willingness of a country’s partners to censure deviations from agreed approaches.

Another potentially important source of gains to participants in RIAs comes from the ability to access partner markets where prices are above world prices because of restrictions on imports from other countries. This situation creates gains to the exporter because of the higher prices received for exports and the ability to increase exports to the partner. In this case, partner protection creates an improvement in the exporter’s terms of trade. These gains to the exporter must be offset by losses to the importer. From the importing partner’s point of view, the expansion of imports from partners—imports that do not generate customs revenue receipts—the expense of reductions in imports from non-partners that generate customs revenues. While it is important to remember that terms-of-trade gains are not generally sources of net welfare gains to the bloc, it remains important to calculate them for each partner.

2.2. Investment

While an RIA doesn’t necessarily require investment, we have recently seen the emergence of a new concept of “comprehensive preferential trade investment agreements” (UNCTAD, 2006). This new generation of agreements covers not only trade barriers but also liberalization of investment flows. It is also consistent with the Baldwin (2016) conjecture that openness to investment is important in allowing developing countries to gain competitiveness in parts of the overall value chain, without necessarily needing to master all stages of the production process.

The commitment issue arises even more strongly in the case of investment (Büthe and Milner 2008). Potential foreign investors are concerned that, unless they are protected by an international agreement, a host country government may take advantage of them by changing its policies after they have made their investments. An international agreement may provide an opportunity for a potential host government seeking investment to make commitments against future exploitation of foreign investors after they have sunk their investments in the country.

The reduction of trade barriers in a free trade area can promote investment by providing domestic firms incentives to acquire capital and intermediate goods. RIAs also favor Foreign Direct Investment (FDI), since greater market access, more competition, and improved policy credibility can improve the business environment and raise incentives for investments. In addition, regulations undertaken during negotiations can also enhance foreign direct investment (FDI) flows by increasing the mobility of funds and capital in the intra-bloc members.

The rationale behind governments’ interest in attracting FDI for development purposes has been emphasized in the Monterrey Consensus on Financing for Development, which argued that FDI “is especially important for its potential to transfer knowledge and technology, create jobs, boost overall productivity, enhance competitiveness and entrepreneurship, and ultimately eradicate poverty through economic growth and development.”

Some care must be taken when attracting investment into economies that are highly distorted. Investment in protected sectors is highly likely to be welfare-reducing for the host country because the income received by the investor exceeds the income to the country when measured at world prices (Brecher and Diaz-Alejandro 1977). This is most unlikely to be the case if the sector to which investment is attracted is export-oriented, because such sectors are typically taxed by protection provided to imports. Trade liberalization greatly reduces the risk that foreign investment will be welfare-reducing.

Under the traditional closed-economy model of development, countries needed to develop all of the inter-linked stages of their industrial sector. This proved extremely difficult to do because of the large amount of learning needed, and the heavy capital requirements for industrial development (Hausmann and Rodrik 2003). Under the new model (Baldwin 2016), developing countries can focus only on those stages in which they have a potential cost advantage.

2.3. Economic performance

Trade generates economic gains partly because factor endowments and factor productivities are different between countries and partly because consumers and input purchasers prefer variety in the goods that they purchase. RIA formation can potentially allow countries to make greater use of trade by reducing the obstacles to trade between its members.

The primary links between RIA formation and economic performance come through the trade creation and trade diversion considered in section 2.1. Reducing tariffs on imports from partner countries creates welfare gains from trade creation because it allows increases in imports that are produced at a lower cost than domestically-produced goods. These gains may be offset by reductions in imports from non-partner countries. This diversion of trade away from non-partner countries generates economic losses by reducing receipts from tariff revenues.

Opening to trade may also raise productivity by allowing access to superior inputs from foreign suppliers (Amiti and Koning 2007). Integrating with more advanced countries may be more helpful both in obtaining access to better products, and has been strongly recommended to developing countries in the economic literature (Schiff and Winters 2003).

Larger markets access, enhanced competition, and improved policy credibility provide domestic firms incentives to increase their production (which could result in economies of scale) and competitiveness both by increasing utilization of their initial capital and by investing in new capital that is more productive. Enhanced productivity and production may also be obtained by clustering because the openness favors the creation or the more effective use of links between firms. The latter could be translated in new or more dynamic value chains shared between member countries, thus encouraging the optimal reallocation of factors and industries. Consumers can benefit from both decreases in prices of imports and higher productivity of firms located within the bloc.

2.4. Foreign relations:

Countries often form regional groups for noneconomic reasons, such as to promote peaceful relations, or to obtain assistance. Integration with a group of democratic countries may also help to lock in democratic procedures. These nonpolitical objectives need to be considered in any evaluation of an FTA.

As noted by Schiff and Winters (2003), there are several reasons why increasing trade between countries might be expected to help promote peace. For a start, increasing interaction is likely to promote greater understanding. It also tends to raise the cost of conflict as countries become more dependent on each other. An agreement may also increase countries’ confidence that they will be able to access strategic raw materials. Finally, of course, countries may assist one another, with assistance typically flowing from richer to poorer countries, as in the European Union.

However, increased trade is not always a successful formula for peace. In fact, trade integration can create conflict, as between the northern and southern states of the United States in the lead up to the US Civil War. The vast increase in global trade in the early 20th century was also seen as a potential raising the cost of conflict and ruling out war between the United Kingdom and the rising power of Germany (Angell 1909). Clearly, the undoubted costs of disruption were insufficient to stop the beginning of World War I in 1914.

3. FTAs vs Customs Unions and Economic Unions

The central element of Free Trade Areas is elimination of trade barriers between partners, with members continuing to maintain their own trade barriers against nonmembers. A Customs Union (CU), by contrast, involves moving to common external trade barriers as well as eliminating restrictions on trade between members (Viner, 1950). An Economic Union is a Customs Union with common policies on product regulation, freedom of movement of goods, services and the factors of production.

GATT Article XXIV requires that entry into an FTA involves no increases in barriers against imports from non-member countries. Under a Customs Union, by contrast, barriers must be, on-the-whole, no higher than prior to the agreement. This means that tariffs on at least some products, in at least some countries, are likely to increase as protection rates are harmonized across members. The negotiations on the setting of a common external tariff are very vulnerable to pressures from particular interest groups.

An attractive feature of FTAs relative to Customs Unions is that FTAs allow member countries to set their own tariffs on imports from non-members. This allows FTA members to negotiate with other partners after accession to an FTA and, if desired, to below to multiple trade blocs. By contrast, countries in Customs Unions must apply the common external tariff. The finding that members of FTAs tend to reduce their barriers against external partners after joining an FTA (Estevadeordal et al 2007) has increased support for FTAs relative to Customs Unions.

One concern with FTAs is that their lack of a common external trade regime creates incentives for suppliers to export products to the member with the lowest external tariffs. Absent any restrictions on such transshipment, the effective trade regime would become that of the least protective member for each product. To avoid this problem, FTAs generally use rules of origin to ensure that products sent from one member to another without facing trade barriers have been completely—or at least substantially—produced within the region. Unfortunately, this requires that customs facilities be retained at borders within the region, and that decisions be made about whether each shipment satisfies the rules-of-origin for that product. Unfortunately, such rules-of-origin can also be captured by protectionist interests, such as the US textile producers who require use of US yarn and fabric for products imported into the USA under the North American Free Trade Area. Once a common external trade regime has been established, Customs Unions have the advantage of not needing rules of origins.

If members of a Customs Union want to move to deeper integration as an economic union, then negotiations on issues such as regulations and modalities for free mobility of capital and labor are required. Such deeper integration has advantages in lowering trade costs within the group, but involves a sharing of decisions that may be politically challenging, as has become clear in the context of Britain’s proposed exit from the European Union.

4. Estimating the Economic Impacts of RIAs

Much of the discussion about the potential gains from FTAs and Customs Unions is challenging for participants without advanced training in economics. Many estimates of the welfare impacts of RIA formation are derived from large and complex models without a clear explanation of how they are derived. In this section, we depict the economic impacts of RIAs using simple graphical techniques.

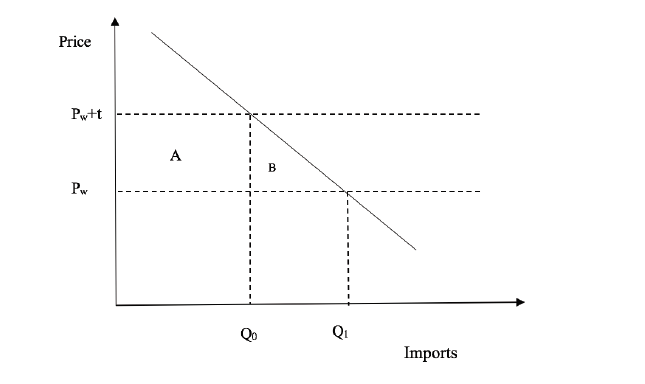

Figure 1 shows the impact of trade creation on the welfare of consumers in the importing country. The downward sloping line shows the demand for the imported good as a function of its price . This demand curve slopes down because the value placed on consuming more of the good declines as they consume more of it. The horizontal line, Pw, shows its international price, while Pw +t shows its initial price in the protected home market, after importers have paid the tariff. Elimination of the tariff lowers the price of the good to Pw and causes consumers to increase their purchases of the good from Q0 to Q1. The economic benefit to consumers from this tariff reduction includes two areas in the figure—area A and area B. The gain measured by area A is a benefit to consumers but a loss to the Treasury. Prior to the change, the Treasury collected revenues of t per unit on the original Q0 of imports. Following abolition of the tariff, it loses these revenues. Area B is the benefit to consumers of being able to buy more of the good following the decline in its price.

Figure 1. The Economic Welfare Impact of a Tariff Reduction

The net social benefit of the lower price of imports is shown by area B in Figure 1. If we think of the move from the initial price (Pw+t) to the final price, Pw, then we can see that a small move in price down from (Pw+t) yields a benefit to consumers of t per unit. Consumers still value each unit consumed at (Pw+t) but they now only need to pay Pw for the good. But as the amount of the good imported increases, the value placed on the good by consumers falls, until the last unit is valued at Pw and costs the consumer Pw.

Figure 1 makes clear that the value of the economic gain from trade creation will depend on two parameters: the initial tariff rate on imports from potential partners, and the slope of the import demand curve from these partners. The higher is the tariff initially levied on imports from partners, the greater the gains from trade creation will be. Similarly, the higher is the slope, the greater the gains

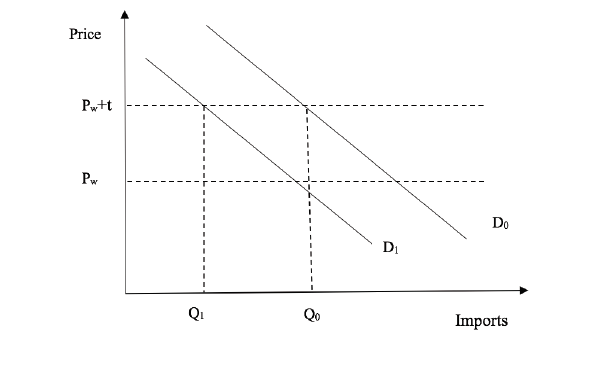

To see the nature of trade diversion, consider a market for goods imported from other, non-partner countries. These goods are subject to tariffs that are not reduced by the FTA agreement. In most cases, these goods will be substitutes for imports from partner countries. In this situation, imports of these goods will decline because of the increased competition they face from now-cheaper goods from partner countries. This situation is shown in Figure 2.

In this Figure, the decline in the price of imports from partner countries shifts the demand for imports from non-partner countries from Q0 to Q1. Each of these imports is valued by consumers at their market price in the country (Pw +t), but costs the country only Pw. The reduction in imports from non-partners therefore costs the country t.(Q0 - Q1). This is equal to the loss in tariff revenue on imports from non-partner countries. If, as is usually the case, it costs more than $1 to raise a dollar in government revenues, then the social cost of trade diversion is actually larger than indicated in Figure 2. But the convention in analyses of trade agreements is to assume that $1 of tariff revenues is valued only at $1.

Just as with Figure 1, Figure 2 gives us some indication of the determinants of the potential losses from trade diversion. For any given reduction in tariffs on partners, trade diversion will be greater the larger the impact of the decline in the price of partner imports on demand for imports from non-partners—a cross-price effect usually summarized using a cross-price elasticity. The second influence on the cost of trade diversion is the height of the tariff on non-partner imports—the higher is this tariff, the higher will be the cost of trade diversion. If, at the other extreme, this tariff is zero, then there is no trade diversion impact to be concerned with when evaluating the proposed agreement.

Figure 2. The market for imports from non-partner countries

The third source of potential welfare gains is the terms-of-trade impact of the RIA. The elimination of trade barriers on exports to partner markets increases the demand for exports from the home country, and may raise the price received for them. The extent of this benefit depends on the initial tariff in the partner country, and the importance of that market. The higher the initial tariff and the larger the share of the partner in the exports of the home country, the larger the gains are likely to be.