China’s FDI in Brazil: recent trends and policy debate

From 2010 onwards, China has become a relevant foreign investor in Brazil, mainly through State-owned companies investing in infrastructure – particularly in the energy sector. In the first years of the current decade, Chinese investment has been widely welcomed in an environment characterized by declining investment rates and low economic growth. However, more recently, some concerns have been raised of an “excessive” dependence of China state companies in sectors perceived as strategic for the economy. Although we cannot discard the possibility that some restrictions to the Chinese investment in strategic sectors end by being imposed, it is not probable that they come to affect a broad range of activities. Brazil needs to dramatically increase its investment rate and will have to rely on FDI to complement domestic savings.

1. Introduction

No region in the world remained immune to the re-emergence of China as a global economic power. Brazil is no exception. In the first decade of this century, China became the main trade partner of Brazil. The two countries are partners at BRICS, considered a “South-South” cooperation forum, but bilateral economic relations are typical of a North-South pattern: China exports manufactured goods to Brazil and imports basic commodities (iron ore and soy beans, essentially) from Brazil.

Despite the efforts to diversify Brazilian exports to China, the tendency to concentrate in a few commodities basket has been intensifying. Bilateral trade continues to reflect typically the basic comparative advantages of each of the two economies. Critics of this pattern of trade argue that by exporting food and raw materials and importing industrialized goods, Brazil faces the risks imposed by the volatility of commodities prices and the so-called Dutch-disease.

From 2010 onwards, China has become a relevant foreign investor in Brazil, mainly through State-owned companies investing in infrastructure – particularly in the energy sector. Chinese investment has been widely welcomed in an environment characterized by declining investment rates and low economic growth.

However, more recently, some concerns have been raised by Brazilian policymakers and analysts pointing out the economic and geopolitical risks of an “excessive” dependence of China state companies in sectors perceived as strategic for the economy. Adding the profile of Chinese investment in Brazil to the bilateral trade pattern, the perception of risks in the bilateral economic relations has grown. This perception was strengthened by the recent evolution of Chinese politics, which seems to confirm the central role of the state owned companies in the country’s development model and internationalization strategies.

During the election campaign, President Bolsonaro alerted that the “Chinese are not buying in Brazil. They are buying Brazil” . The concentration of Chinese investment in some “strategic sectors” has raised concerns among the new government supporters. President Bolsonaro mentioned particularly that the permission to foreigners to buy land or to control industries in strategic areas should be reviewed.

This article assesses the evolution and the make-up of Chinese foreign direct investment (FDI) in the world and in Brazil, comparing with its profile in Africa and South America, and discusses the dilemmas and strategies for the Brazilian economic policies towards China.

2. Raising concerns with China’s emergence as a relevant investor in strategic sectors

The internationalization of the Chinese economy gained strength in the beginning of the years 2000, when the country adopted the Going Global strategy to promote investments abroad. This was a major break with the prevalent policies of restricting FDI operations of Chinese companies .

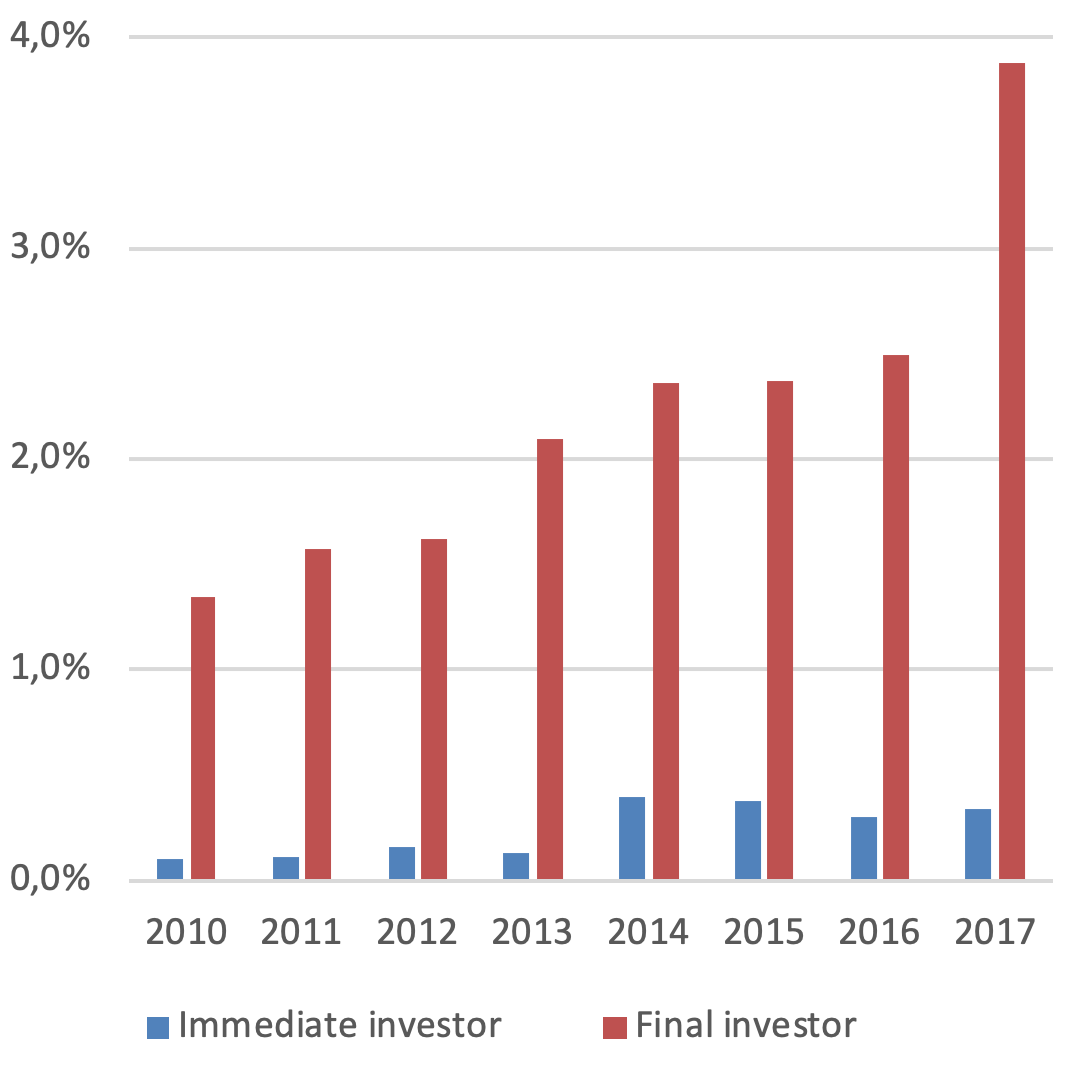

This new strategy contributed to foster the emergence of China as one of the most relevant sources of FDI in the world. According to UNCTAD (2018), the share of China in the stock of total outward FDI grew from 0.2% in 1990 to 1.5% in 2010. Despite this remarkable performance, it was only after 2010 that the expansion of Chinese capital invested abroad began to draw attention: in 2017 it represented 4.9% of global FDI (Figure 1).

Figure 1 : Participation foreign direct investment: outward, stock (%)

Source: Unctad, WIR (2018)

It is important to note in Figure 1 the significant participation of Hong Kong as an origin of FDI; it is quite similar to the relevance of Germany or Japan. Due to the special relations between China and Hong Kong and to the complex regulations in China, many authors consider that part of the investment originated in Hong Kong has, in fact, Chinese companies as the final investor. On the other hand, part of the Hong Kong FDI, might represent reinvestment operations in China – the so called triangulation.

Casanova et al. (2015) undertook an effort to identify the distortions incorporated in the Chinese FDI official statistics, calculating the relevance of Hong Kong as an intermediate passage point to the Chinese investment abroad. Many other authors developed different methodologies to estimate to effective flows and stock of Chinese FDI. In general, they conclude that the official data published by China’s Ministry of Commerce (MOFCOM), overestimate the stock of Chinese FDI.

In order to deal with these distortions, different databases have been developed by private institutions. One of them is the China Global Investment Tracker (CGIT) published by the American Enterprise Institute, which has been used by several authors. Relying on information provided by corporations, this database considers the final destination of the investment operations, and only counts the total value of the transaction when the investment is confirmed.

According to CGIT data, Chinese outward FDI fell sharply in 2018, after a long period of expansion. This decline was more accentuated by the end of the year and is attributed to the slowdown of the foreign investment of state-owned companies (SOEs), which dominate Chinese investments abroad . As Scissors (2019) points out, one explanation to this performance might be the Chinese government’s caution in drawing down its foreign exchange reserves. But it is inevitable to recognize that China’s globalization has been under pressure not only at home, but mainly abroad.

Figure 2 : Chinese Investment: flows (US$ bi)

Source: American Enterprise Institute e Heritage Foundation, China Global Investment Tracker, 2018, www.aei.org/chinaglobal-investment-tracker.

At home, in the first semester of 2018 China faced a current account deficit for the first time in 17 years. The ambitious Belt and Road Initiative (BRI) involves a huge amount of investment and includes many non-for-profit infrastructure and construction projects abroad that compete with SOEs’ outward FDI to the access to foreign exchange reserves. Some of these companies have been showing poor returns at home. Those factors combined to cap foreign currency available to private and state owned enterprises to invest abroad in 2018 (Scissors, 2019).

According to Huang et al. (2019), the slump in of Chinese investment abroad was a confluence of factors, including:

(i) A series of restrictive measures implemented by the Chinese government to combat capital flight, significantly slowed China’s non-financial FDI abroad;

(ii) Overseas, Chinese investment has been facing political and policy reactions, mainly in developed countries – the United States and, more recently, Western European countries such as Germany and France. Western countries have tightened their screening on Chinese investors, resulting in the cancellation of 21 cases of Chinese investments, worth US$ 25 billion;

(iii) Domestic economic downturn hindered Chinese firms from making more investments abroad. Sluggish domestic growth affected Chinese firm’s appetite for international assets.

According to Silva (2015), after the adoption of the Going Global strategy by China in the early 2000’s, it is possible to identify two different periods in the evolution of Chinese investment abroad:

(i) 2004 to 2008: fast growth of greenfield investments, motivated by resources-seeking and market-seeking interests, concentrated in Africa, Asia and ex-URSS countries;

(ii) 2009-2013: Latin and North America and Europe gain relevance as destinations and acquisitions turn to be the main modality for Chinese FDI. Those investments turn to be less concentrated regionally and sectorally.

Along with the internationalization process of Chinese companies, motivations for FDI turned out to be more diversified. Resources-seeking and market-seeking continue to be relevant, but acquisitions abroad have been increasingly oriented by the interest in access to innovation, research centers, technology development and design.

Despite the increasing participation of private companies, the main drivers of the Chinese FDI, in terms of the amounts invested, are the Stated Owned Enterprises (SOEs), particularly those operating in the oil and petrochemicals, energy, mining, infrastructure and food sectors . The motivations behind the globalization of those companies include economic considerations, but those investments raise concerns that they main represent the geo-political interests of the Chinese State, mainly those related to energy and food security or the access to high technology.

To deal with those concerns, some countries have been tightening their screening mechanisms and controls and/or imposing new barriers to Chinese investment. In some developing countries, Chinese FDI operations involved the temporary flow of Chinese workers, inciting the debate on their impacts on local labor markets. In other countries, regulations were changed to impose restrictions to the acquisition of land or strategic infrastructure assets.

In the United States, under President Trump’s Administration, the Committee on Foreign Investment in the United States (CFIUS) — the U.S. regulatory body charged with screening foreign investment — has become much more severe in its procedures. Several major deals involving Chinese investors were called off in the first part of 2018, with players citing issues with CFIUS . In August 2018, the Foreign Investment Risk Review Modernization Act took effect in the United States. This bill was aimed at screening foreign investments (especially from China) into the US and control high-tech exports .

In Europe, the increase in Chinese FDI flows into strategic sectors has fostered a debate on the convenience to establish a screening mechanism, at the European level, on the grounds of national security and/or public order (Esplugues, 2019). There is an increased concern in some European countries, mainly in France and Germany, about the acquisition by Chinese SOEs of European high-tech firms.

This issue emerged in the public debate at the European Union level in 2016, when, in an emblematic operation, the robot maker Kuka was acquired by the Chinese appliance maker Midea. At that time, EU authorities unsuccessfully appealed to European companies to present some offer to buy Kuka.

The manifesto for an “European industrial policy fit for the 21st century”, launched by France and Germany in February 2019, seems to be a reaction to the perceived risks for Europe of the increasing role of China in the high-tech and infrastructure areas and the fact that European industries are lagging behind.

3. The emergence of Chinese FDI in Brazil

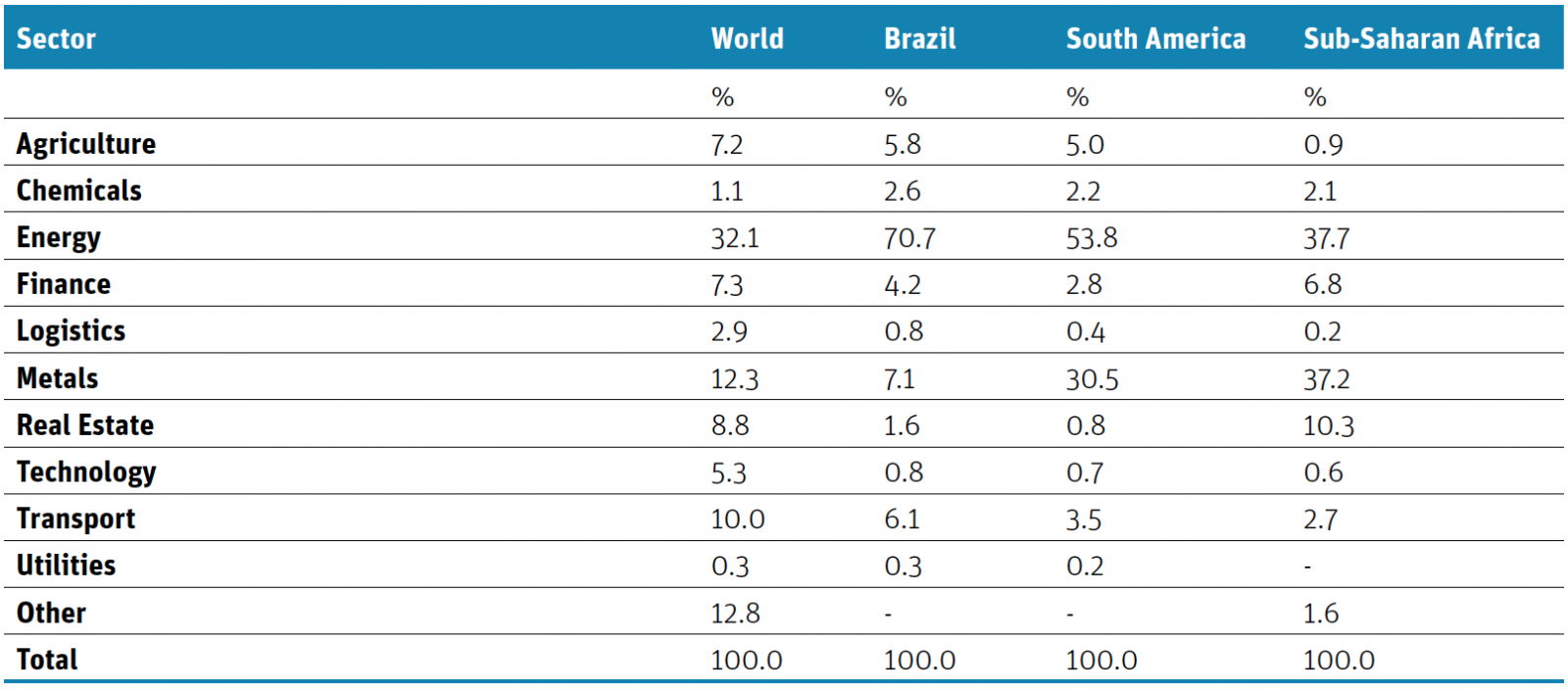

Brazil was a latecomer as a destination of Chinese FDI. According to Brazil-China Business Council - CEBC (2013), “investment of Chinese companies in Brazil only came to gain relevance in 2010”. The presence of Chinese FDI in Brazil is still modest, in terms of stock, occupying the 25th position in the ranking of foreign investors in the country, in 2016, considering the immediate origin of the investor. But China scales up significantly in the ranking of foreign investors – from the 25th to the 13th position – when the final origin of the investor is taken into account. This difference is due to the fact that a relevant share of Chinese FDI flows to Brazil through other countries, and is not remitted directly from China.

According to data presented in a recent publication Relatório de Investimento Direto no País, by the Central Bank of Brazil – Banco Central do Brasil (2018), almost the totality (more than 90%) of the Chinese FDI in Brazil from 2010 to 2013 was channeled through intermediate countries. From 2014 onwards, this percentage has been oscillating around 83% to 98%. In the case of Brazil, the most relevant intermediate country for Chinese FDI is Luxembourg. As Figure 3 shows, the Chinese share of the total FDI stock in Brazil reaches 3.9% when the final investor criterion is adopted, but accounts only for 0.3% using the immediate investor criterion.

Figure 3 : China's participation in foreign capital invested in Brazil, stock - 2010-2017

Source: Banco Central do Brasil (2018)

The difficulties to estimate precisely the value of the Chinese FDI are revealed by the significant differences in the numbers provided by different official sources. While the Central Bank of Brazil (2018) indicates that between 2014 and the first semester of 2018 the flows of Chinese investment in Brazil accumulated US$ 20.7 billion, for the same period, the team of the Secretariat of International Affairs of the Ministry of Planning, Development, and Management (SEAIN-MPDG) estimates an amount of US$ 28.6 billion. A difference that exceeds 38% of the value published by the Central Bank, which is based on the Balance of Payments flows .

If we do not take into account the distortions caused by intermediate countries, and exclude only the countries considered non-cooperative tax jurisdictions (using the European Union criteria), we will find that the Netherlands, followed by the United States and Luxembourg were the three main sources of FDI in Brazil in the period of 2015-2017. Spain, France, Germany, United Kingdom and Japan were relatively relevant, as well. In this case, China appears as responding only for 0.8% of total FDI in Brazil in that period (See Figure 4). But if we take into account the special study published by the Brazilian Central Bank and mentioned above, and consider the Chinese FDI that goes through Luxemburg to Brazil, it amounted US$ 17.4 billion in the period 2015-2017. Hence, China would be the third largest investor in Brazil during that period, accounting for roughly 10% of the total flows in those years.

Figure 4 : Foreign direct investment in Brazil: flows by country of origin (%)

Source: BCB

*Excluding non-cooperative jurisdictions

To compare Brazil with other destinations of Chinese FDI we use data provided by the CGIT. Brazil figures in the fifth position as destination of Chinese FDI in the world, according this data, accumulating operations confirmed from 2008 to 2018. It is important to note that the four countries that appear before Brazil in this ranking are all developed countries.

Table 1 : China’s direct investments flows 2008 - 2018: Top 10 countries

.png)

Source: American Enterprise Institute e Heritage Foundation, China Global Investment Tracker, 2018, www.aei.org/china-global-investment-tracker.

The figures presented in Table 2 confirm the fact that Brazil was a late comer as a destination of Chinese FDI. Until 2008, the investment operations of Chinese companies in Brazil were negligible. It was only from 2010 onwards that China emerges as a relevant investor in the Brazilian economy. From 2008 to 2018, total capital invested by China in Brazil amounts to US$ 59.4 billion, according to CGIT, representing 51% of the total Chinese FDI in South America in the same period. During this same period, China invested US$ 74 billion in Sub-Saharan Africa, which means 64% of the value invested in South America.

Table 2 : Participation of Brazil, South America and Sub-Saharan Africa in China's FDI (%) 2008-2018

Source: American Enterprise Institute e Heritage Foundation, China Global Investment Tracker, 2018, www.aei.org/china-global-investment-tracker

Table 2 indicates that Brazil gained relevance as a destination of China’s FDI along this decade, but the Chinese investment in the country lost traction in 2018. As shown in Section 1, this was the case for Chinese FDI in general. But when we compare Brazil to South America and Sub-Saharan Africa, we realize that in the case of Brazil this loss is very steep and that South America and Africa received very significant amounts during that year.

Beyond the fact that the Chinese investment overseas fell significantly in 2018, uncertainty may be the main explanation for the retreat of Chinese FDI in Brazil last year. Data compiled by United Nations Conference on Trade and Development (UNCTAD) for the first semester of 2018 show that global FDI fell 41% compared to the same period in 2017 and that Brazil presented the largest fall among destinations in South America. However, concerns related to possible changes in FDI regulations and to the handling of Chinese operations in Brazil by the new government elected in October might have made Chinese investors adopt a more cautious approach towards their investments in the country.

4. The changes in the sectoral make-up of Chinese FDI in Brazil

China’s emergence as a new and relevant source of FDI in the world – from the beginning of the 2010s onwards – nurtured expectations that the country would contribute to the development of infrastructure and of high value-added industrial projects in Brazil. Although the expectations related to the investment in high-tech industrial projects and the creation of qualified jobs have been largely frustrated, Chinese capital has been flowing to infrastructure projects and particularly to the energy and electricity sector.

According to CEBC (2017), it is possible to identify in four different waves the trajectory of Chinese investment in Brazil. “The first wave of large investments was essentially resource-seeking, which accentuated the dominant view in the international debate on the motivations of Chinese companies when investing abroad.” In the second wave – between 2011 and 2013 – there was a sectoral diversification of Chinese FDI in Brazil, oriented by market-seeking interests. During this period, Chinese companies focused on opportunities in industry (machinery and equipment, automobiles and electronics).

In the third wave, financial services were the main destination of Chinese capital. In this period (2013 to 2015), Chinese banks were established in Brazil through greenfield operations or via acquisition of shares in Brazilian or foreign banks operating in the country. The fourth wave begins in 2015 and is characterized by the substantial amounts invested by the Chinese companies in the energy sector in Brazil. Agribusiness remained a relevant destination sector in this wave.

The energy sector captured 71% of the stock accumulated by the Chinese FDI in Brazil until 2018. Although this is the sector that concentrates the largest share of Chinese investment overseas, its relevance in the Brazilian case is striking. Metals, transport and agriculture come in the second, third and fourth positions as sectoral destinations of Chinese FDI in Brazil. Investments in steel plants were predominant in the first wave, while transport and agriculture were present during the whole period. ( See Table 3).

Table 3 : China's FDI by sectors - World, Brazil, South America and Sub-Saharan Africa - Investments accumulated until 2018, % of total investment in the region/country

Source: American Enterprise Institute e Heritage Foundation, China Global Investment Tracker, 2018, www.aei.org/china-global-investment-tracker

South America and Sub-Saharan Africa share similar profiles in terms of Chinese FDI sectoral allocation, with predominance of investment in the sectors of energy and metals. The main difference between the two regions relates to the relevance of real state and finance in Africa, two sectors that are not relevant for South America. Although for Brazil metals rank in the second position in terms of the sectoral allocation, it is much less important than it is for South America and Sub-Saharan Africa. The comparison of the sectoral allocation of Chinese FDI shown in Table 3 indicates that a good deal of those investments in Brazil, South America and Sub-Saharan Africa is resources-seeking.

As noted by Baumann (2017), Chinese investment in the agricultural sector in Brazil goes beyond the production of food and incorporates operations in energy, railways and ports infrastructure, aiming to control most of the production chain.

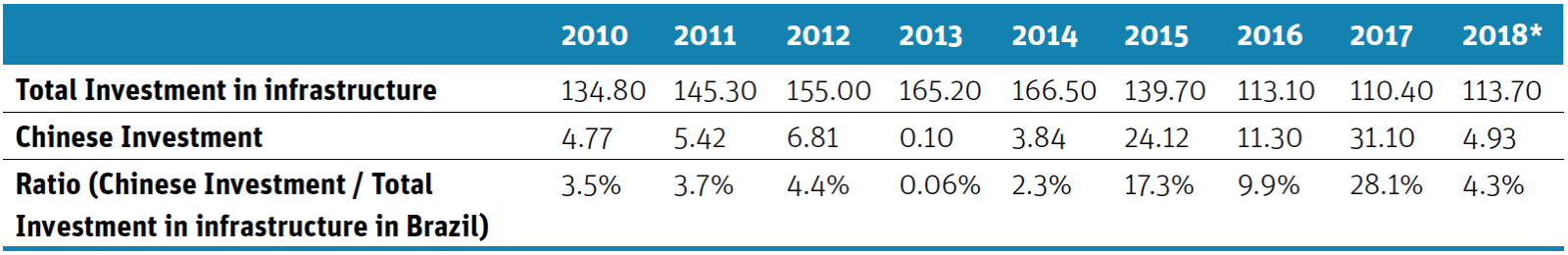

Furthermore, in the current decade, China turned-out to be a relevant investor in infrastructure in Brazil. SEAIN-MPDG (2018) estimates Chinese investment in infrastructure in Brazil, using a methodology developed by the Brazilian Association of Infrastructure and Basic Industries (ABDIB) . They show that Chinese capital had a remarkable participation in the amount invested in infrastructure in Brazil during the current decade.

Table 4 : Total and Chinese Investment in Infrastructure in Brazil R$ trillion

Source: SEAIN-MPDG

Table 4 shows that, according to SEAIN-MPDG estimates, Chinese capital in Brazil represented 17.3% of the total invested in infrastructure in 2015 and 28.1% in 2017. Considering the amount invested in this area during the whole decade, China’s participation in the total investment in infrastructure was around 7%.

The interest of China in investing in the food production-chain and infrastructure in Brazil has been generating mixed-feelings in the public opinion and policymakers, feeding the discussion on how should Brazilian policies deal with Chinese investment.

5. Brazilian strategies and policies towards Chinese investment

Efforts to attract Chinese FDI are part of the Brazilian governmental agenda since President Lula’s trip to China in 2004. At that time, China was emerging as an economic power and Brazil already had the diversification of its exports to China and the attraction of Chinese FDI to Brazil as its main objectives for the bilateral agenda.

During that visit, Brazilian government committed to grant market economy status to China and in turn Chinese government mentioned the intention to invest US$ 10 billion in Brazil until 2007. Those promises were not accomplished during that period. Brazil never recognized China as a market economy and Chinese investment only came to be relevant some years later.

Since then, several bilateral cooperation mechanisms were implemented. Official visits, business missions, two Joint Action Plans and the creation of high-level bilateral commissions were undertaken, among other initiatives. Long lists of impressive amounts of investments used to be announced at each high-level meeting. But it was only after 2010 that China began to be recognized as a relevant source of investment in Brazil.

In the first part of the current decade, Brazilian policymakers nurtured the expectations that Chinese capitals could flow to industrial projects, particularly in the information technology and telecommunications sector, contributing to the development of a local production-chain and the transfer of technology. CGIT databank registers investments of three big Chinese companies in Brazil during this period: ZTE, Lenovo and Huawei.

The announcement in 2012 that Foxconn would invest US$ 500 million in the production of iPhones e IPads, with the construction of five plants in São Paulo was very welcomed by Brazilian authorities. But despite the fact that some local production have begun, the amounts invested were much lower than those announced and they do not appear even in CGIT. The amount of Chinese FDI in technology sectors in Brazil (where IT and telecommunications products are classified) do not reach 1% of China’s total investments in the country.

Discrepancy between the amounts of announced investments and those that are confirmed are due to several factors: (i) the fact that, when announced, many projects are still being prospected, being abandoned afterwards; (ii) projects are implemented but capital is invested in the course of several years; (iii) capital invested flows from intermediate countries, as already noted; and (iv) business activities related to cooperation, financing or exports or services are often treated as investment, inflating the figures of expected FDI flows.

According to CEBC (2014), “increasing knowledge of the conditions of Brazilian market for the implementation of investment projects might have influenced the decisions of Chinese companies investing in Brazil. As is well known, difficulties related to a cumbersome bureaucracy and a complex tax regime are among the main difficulties faced by Chinese companies to operate in Brazil”.

Opinion polls conducted by CEBC with Chinese companies investing in Brazil suggest that the most relevant factors affecting the decision to invest are: (i) capacity to maintain high level and fluid dialogue with local authorities; (ii) experience of other Chinese companies that already operate in the country; (iii) opportunities and profitability of the business itself; (iv) business environment; and (v) dimension of the market.

Despite those differences, it is impossible to deny the relevance gained by Chinese FDI in Brazil since 2010. The nature and motivations of these investments have evolved, but the high involvement of Chinese SOEs and its destination to sectors considered strategic are on the stage of political debate in Brazil regarding bilateral relations.

This factors combined have already spurred political and policy reactions in Brazil. The announcement by Chinese SOEs of their intention to buy agricultural land in Brazil in the beginning of the decade led Congressmen to propose legislation (PL 4059/12) to restrict the acquisition of rural real state by foreigners. This proposal was not voted but continues to be in the agenda of the Brazilian Congress.

6. Perspectives

President Bolsonaro’s declarations, during his electoral campaign, calling attention to the risks involved in the acquisition by Chinese companies of land in Brazil or the control of strategic sectors were aimed at addressing this kind of concerns. Although these declarations might be welcomed by a minority of the population worried with security issues, Brazil faces an immense gap of investments in infrastructure and will need to count on FDI to cope with the challenges by the shortage of domestic savings. China may have a tortuous road ahead, but there is little doubt that the country will continue to be a relevant source of FDI in the foreseeable future.

Furthermore, China needs to count with profitable FDI projects to compensate for the poor results SOEs are having in their operations at home and for the many non-for-profit projects included in the Belt and Road Initiative. In Brazil, there are many profitable investment opportunities.

In 2015, Brazil and China created the China-Brazil Fund, which has an expected allocation of US$20 billion, with the Chinese Investment Cooperation Fund in Latin America (Claifund) being responsible for US$15 billion and Brazil for the remaining US$5 billion, which will preferably come from the National Bank for Economic and Social Development (BNDES). This Fund has an unprecedented financial architecture: resources will be disbursed on a project basis; the proportion of contribution by the two countries is 3 to 1, but the decision mechanism is 1 to 1. The resources will be disbursed on a project basis .

Brazil is on the verge of inaugurating a new and ambitious privatization program and the participation of Chinese companies in this process will contribute to increase the selling values and the return of those operations. For instance, China has two big companies operating in the electric sector in Brazil - Three Gorges Corporation (CTG) and State Grid. Those companies have 10% to 20% of their assets allocated overseas, and Brazil is responsible by half of them. With the imminent privatization of Eletrobras , those companies will probably stay in Brazil and participate in the privatization process .

The response to the Chinese investment in strategic sectors in Brazil might not be the imposition of barriers or restrictions, but rather the improvement of regulation and the monitoring of the operations to guarantee that they comply with local legislation. Moreover, the cooperation between BNDES and its Chinese counterpart in the China-Brazil Fund can contribute to finance and to technically guide the investment of Chinese companies in the Brazilian infrastructure in the next years.

The expectations that Chinese companies would invest in the industrial sector in Brazil and help to develop high value-added production chains, including through technology cooperation, have been largely frustrated, as mentioned in the previous sections. Targeting Chinese FDI to the industrial sector will not, probably, be a priority of the new Brazilian government. Nevertheless, if the business environment improves with the announced domestic reforms, it is natural that Chinese companies will come and invest in some industrial sectors.

7. Conclusion

Despite the significant growth of Chinese investment in Brazil from 2010 onwards, the relevance of China as a source of foreign capital to the Brazilian economy is still moderate. As mentioned before, China occupies the 13th position in the rank of final investors in Brazil, and annual flows have been decreasing recently. Furthermore, Chinese FDI in the Brazilian economy is very concentrated in the energy sector, which represents more than 2/3 of the Chinese stock of capital invested in the country.

It is precisely this concentration in the energy sector, considered strategic by some politicians – combined with some operations of land acquisitions by Chinese companies earlier this decade – that raises concerns and stimulates the discussion of imposing screening conditions for China’s FDI in Brazil.

Although we cannot discard the possibility that some restrictions to the Chinese investment in strategic sectors end to be imposed, it is not probable that they come to affect a broad range of activities. Besides, Brazil needs to dramatically increase its investment rate and will have to rely on FDI to complement domestic savings. China has the potential to be a relevant source of capital in a new phase of Brazilian economic development, particularly in the infrastructure sector.

#MoroccoBrazil related publications:

Policy Paper: MERCOSUR experience in regional integration: what could Africa learn from it?

Opinion: Morocco and Brazil: Perspectives for a Strengthened Relationship