Facilitating food trade within ECOWAS

The Economic Community of West African States (ECOWAS) is a grouping of about 15 West African countries that have opted for economic integration to contribute to their progress and development. As the Community treaty clearly states, this implies the creation of a common market, in particular by liberalizing trade between member countries. The ECOWAS Trade Liberalization Scheme (ETLS) is the main institutional arrangement implemented at the community level. Other arrangements accompany it, such as the customs union of the West African Economic and Monetary Union (UEMOA).

The development of the agricultural sector is also one of the main objectives of the countries of the economic community. Supporting this ambition, several studies have highlighted an important potential for agricultural production in the region and the capacity of the agricultural sector to be a vector of integration. Through the effective use of comparative advantages, ECOWAS could benefit as much from sub-regional integration as from integration into global value chains.

In response to the very high growth in food demand (resulting from population growth, urbanization and income growth) and changes in food consumption patterns, the West African agricultural sector is pursuing a growth path. Beyond production, the upstream and downstream segments of agricultural value chains are now becoming significant and are expected to grow the most in the coming decades. The food economy (all production, processing and distribution activities contributing to human food) represented USD 178 billion in 2010, equal to 36% of the regional GDP. The upstream and downstream segments represented 40% of the food economy added value. Thus, the strong expansion and deep changes observed in the sub-regional food economy offer opportunities for agricultural growth, investment and job creation, particularly in processing and distribution.

From the point of view of a common food market, they also offer opportunities for growth of trade between these countries. Given these opportunities and the increasing importance of food trade for these countries and for the community (as indicated by the growth in export flows in Table 1), states must play their role as trade facilitators by ensuring appropriate policies and investments.

In the case of Community trade, which is the subject of this article, despite the age of the liberalization and integration policies adopted by these fifteen countries, several studies have indicated a low level of trade integration. The persistence of this state of affairs is apparent in the most recent statistics. By 2015, the share of food exports from these fifteen countries to the Community was 11.

Table 1: Exports of ECOWAS food products (Exports in thousands of USD and share of regional trade)

Source: Author calculations from UNCTADSTAT data

Beyond constraints related to the supply and demand of products within the sub-region, this paper aims to understand this low trade integration by analyzing three other categories of factors for agricultural products that determine the propensity of economic agents to trade in the sub-region. These include tariff measures, non-tariff measures and the quality of infrastructure and logistics.

A comprehensive cost analysis

To begin, it is necessary to take the overall measurement of all the trade constraints in the community. Few indicators can synthesize such a mass of information. This measurement will be based on the calculation of bilateral trade costs between country pairs. These costs have the advantage of aggregating the effects of geographical distance, connectivity to international transport networks, facilitation and logistics performance of the countries concerned, infrastructure and border crossing conditions for neighboring countries, trade policy (tariffs), and the impact of restrictive non-tariff measures. A higher bilateral cost corresponds to a very sharp reduction in trade.

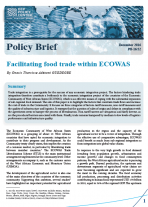

Figure 1 summarizes these costs for agricultural and manufacturing products, between ECOWAS countries and with a non-ECOWAS partner (France) as a benchmark. It shows that for agricultural products, the bilateral costs of trade between Community member countries are much higher than those observed in their trade with France. It demonstrates for example, that for Senegal, trade with Togo is over six times more expensive than it is with France. The red circle on the figure indicates a concentration of trade costs with France in a lower cost area, unlike intra-ECOWAS trade costs. The two lowest cost levels are observed with France as a trading partner.

Figure 1: Bilateral trade costs in 2012 for ECOWAS countries

Data source: data from the World Bank UNESCAP Trade Costs Database

It is therefore cheaper for ECOWAS countries to trade with a European partner than to trade between each other. This conclusion is a paradox given the proximity of these countries and their renewed commitment to integration. The rest of the article will be devoted to a breakdown of these costs to identify some bottlenecks.

Tariff measures

The levels of tariff barriers between ECOWAS member countries are a direct consequence of the different levels of implementation of the UEMOA and ECOWAS FTAs at both national and supra-national levels.

UEMOA has made considerable progress in dismantling tariff barriers to trade, both for industrial and agricultural products. For the latter, the free movement of import duties and import taxes has been effective since 1996. This was applied a bit later for industrial products and therefore for agro-industrial products. At the national level, it is now possible to observe a real application of this measure by the UEMOA member countries, which results in almost zero tariffs on agricultural products, processed or unprocessed (see Table 2).

On the other hand, the level of dismantling of tariff barriers in intra-ECOWAS trade involving a non- UEMOA country is much lower than that encountered in intra-UEMOA trade. As a result, high tariff levels can be seen in Table 2 (red numbers). Indeed, despite the establishment of the ETLS since 1979 and most recently its customs union, the tariff reductions are not fully effective, and this applies particularly to processed products (which are part of industrial products).

The delays experienced by certain countries in the application of Community provisions, and especially the difficulties encountered in the use of rules of origin for duty-free movement of industrial products, may contribute to explaining the high tariff levels applied to many processed agricultural products. As discussed in the next section, very few companies are beneficiaries of the Community Certificate of Origin in the ECOWAS countries. High tariff levels are also due to the extent of re-exporting in the sub-region.

Table 2: Matrix of tariffs applied by ECOWAS countries on agricultural products 2012-2014

Source: Author calculations from UNCTAD data - Trade Analysis Information System (TRAINS).

Non-tariff measures (NTMs)

Non-tariff measures (NTMs) are defined as political measures, other than customs tariffs, that can economically affect international trade in goods, by changing the quantities traded, prices, or both At the global level, after the progressive dismantling of tariff barriers (customs tariffs), NTMs quickly emerged as the main constraints to international trade. However, their main objective is not to protect markets, but to control products traded for health, environmental reasons, etc. They are also used for the purpose of ensuring the quality and recognition of certain goods, maintaining a detailed report on exports and economic activities, and collecting tax revenues. Nevertheless, these measures are perceived as major challenges to regional integration, particularly within ECOWAS.

The complexity of mitigating the effects of these forms of trade constraints is not limited to the legitimate nature of trade partner settlements. NTMs are highly diversified, ranging from measures affecting imports (including technical and non-technical measures) to measures affecting exports.This complexity is also due to the large number of procedural obstacles (PO) that are related to NTMs. POs are practical problems faced by companies in complying with the various regulations imposed (NTMs). They can be encountered at the administrative or logistical levels.

According to recent International Trade Center (ITC) surveys, NTMs are found to be diverse and ubiquitous in intra-regional trade in agricultural products.They are found both at the level of the country of origin (national NTM) and at the country of export destination. 26% of the NTM cases considered to be restrictive are encountered in the country of origin, while 30% are encountered at destination. In addition, 40% of the NTM obstacles faced by exporters of agricultural products in foreign markets are encountered in the sub-regional market.

The different NTMs affecting agricultural exports and encountered at origin and destination are shown in Figure 2. Conformity assessment, royalties, taxes and other para-tariff measures are the main NTMs encountered at destination, while inspection and export taxes and charges are the main NTMs encountered at origin.

What makes an NTM a barrier (from a business perspective) is either that it is overly stringent and difficult to comply with (regulatory barriers) or related practices (procedural barriers) that make it difficult to comply with NTMs, or both at once. The ITC's investigations indicated that the compelling perception of NTMs in the country of origin is largely due to procedural barriers. In terms of NTMs encountered at destination, it is more a matter of regulatory barriers. Indeed, it has been found that 73% of national NTMs that are considered as a barrier to intra-regional agricultural trade are mainly due to procedural barriers, while 67% of the NTM barriers in the ECOWAS partner country are due to regulatory barriers.

Figure 2: NTM hindering intra-ECOWAS agricultural exports

Source: NTM Business Surveys, International Trade Center

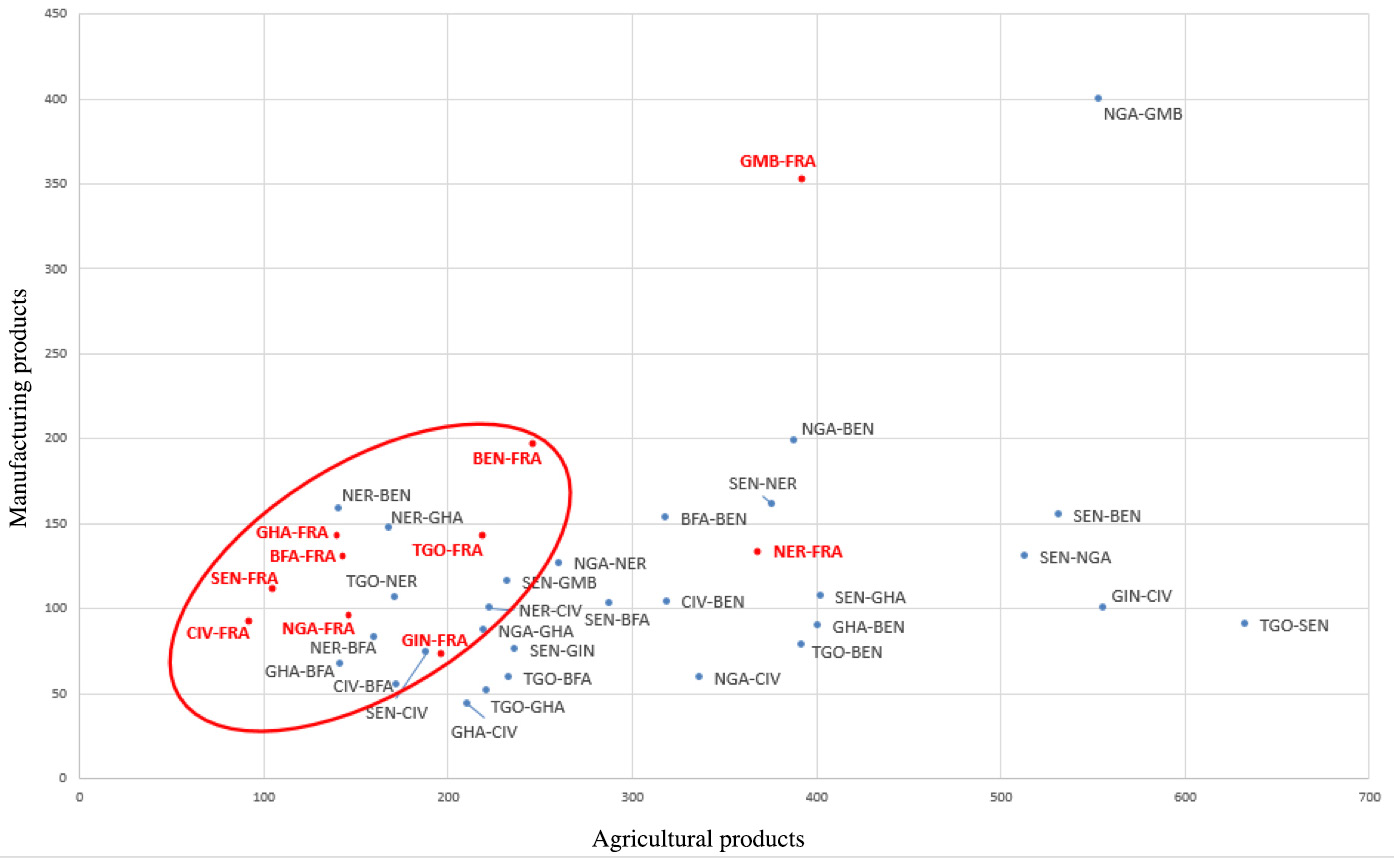

Figure 3: NTM obstacles applied by the ECOWAS partners (left); Related procedural obstacles (right)

Source: NTM Business Surveys, International Trade Center

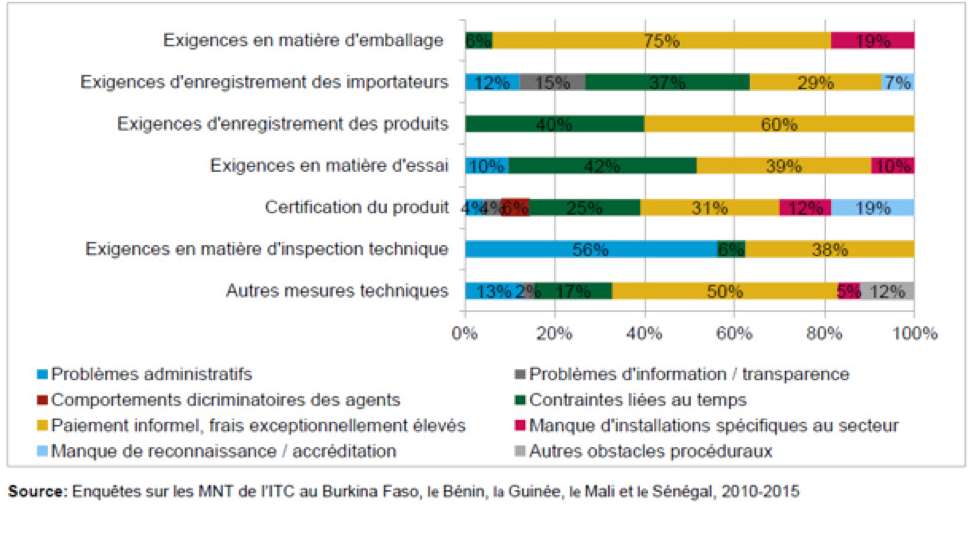

Figure 4: Restrictive NTMs applied in the country of origin (left). Related procedural restrictions (right)

Source: NTM Business Surveys, International Trade Center

The results of these surveys also indicated that the importance of different types of non-tariff measures, as well as related procedural barriers, varies across countries, sectors, business size and whether the firm is an exporter or an importer, or both. The NTMs encountered at destination are broken down into technical measures and non-technical measures. Technical measures affect unprocessed materials more than processed ones, which are more affected by non-technical measures.

Concerning technical barriers, pre-inspection, packaging and product certification requirements are the main perceived constraints (see Figure 3). Procedural obstacles are the main reason for the compelling perception of these technical measures. The eight types of POs related to technical measures are also shown in la Figure 3. For example, informal and high costs, as well as long delays or delays in the product certification process, are the main procedural obstacles related to this measure.

These procedural obstacles occur in both the exporting countries and in the ECOWAS partner countries. They also involve different institutions or stakeholders such as customs, certification agencies, conformity assessment agencies, export / import control / inspection agencies, transportation entities as well as ministries. All these stakeholders in the export process create procedural obstacles at different levels of impact. For example, customs are well known for informal and high payments, long processing periods and delays, administrative issues, lack of recognition / accreditation and discriminatory behavior by their agents. The first two POs are found in virtually all institutions.

As for non-technical barriers, they constitute a constraint on the development of trade in agro-industry products in the sub-region and thus contribute to hindering the development of this sub-sector. In addition to customs surcharges, rules of origin and additional pre-shipment inspections are non-technical NTMs that companies perceive as obstacles. Apart from the more or less rigorous nature of these measures, they are also linked to a number of procedural obstacles.

The application of the rules of origin in the framework of the ECOWAS TLS is constraining mainly because of the long procedures involved in the approval and the obtaining of certificates of origin. These measures are also associated with informal payments in both origin and destination countries. All of this results in the fact that few companies and products are approved by the ETLS (see Table 3). Unnecessary costs and delays are also associated with pre-shipment inspections. These procedures are often repeated in the country of origin and destination. Customs surcharges are mainly due to regulatory obstacles. They can be perceived as a hidden replacement of tariffs and their widespread use has an impact on regional exporters (rising commodity prices, loss of profits, loss of competitiveness). Other non-technical barriers are: import controls and monitoring requirements; quantitative control measures; other royalties and taxes; and other import measures.

Table 3: Companies and products approved by the ETLS in four ECOWAS states

Source: ITC and AFDB (2016)

The restrictive NTMs applied in the country of origin affect all the products concerned, independent of the destination market. The importance of the various constraining NTMs applied at origin is illustrated in Figure 4. Pre-export inspection is the main constraint. From the most to the least important, it is followed by export bans, export licenses or permits, required destination certification, other export measures and registration requirements.

Procedural barriers still emerge as the main reasons for the perception of NTMs as barriers in the exporting country. They are also represented in Figure 4. The main finding is that time constraints (tedious conformity assessment procedures and related controls) as well as informal and high payments are the main reasons for perception of all NTMs applied at origin as barriers. Also, administrative burdens impede the obtaining of export permits or licenses. Finally, the lack of specific facilities or equipment handicaps export certifications, given the technical requirements for certain products.

In the country of origin, informal and high payments, long delays, as well as administrative issues are the most frequent practical difficulties and are encountered in practically all the institutions (customs, ministries, port authorities, various agencies mentioned above). As for the others, the first two are more frequent at the customs level (and other national bodies responsible for inspections). Customs agencies are also associated with all procedural obstacles.

Business environment

Beyond the tariff and non-tariff constraints on trade, the development of trade in agricultural products is also dependent on the quality of transport infrastructure and logistics on the country level, in general, and at the cross-border level, in particular. The transport of agricultural products, especially fresh produce, requires good road infrastructure in order to minimize post-harvest losses and maximize business profits. These same objectives require speed in cross-border procedures. The transport of agricultural products also requires logistics that can maintain the product quality, such as an uninterrupted cold chain.

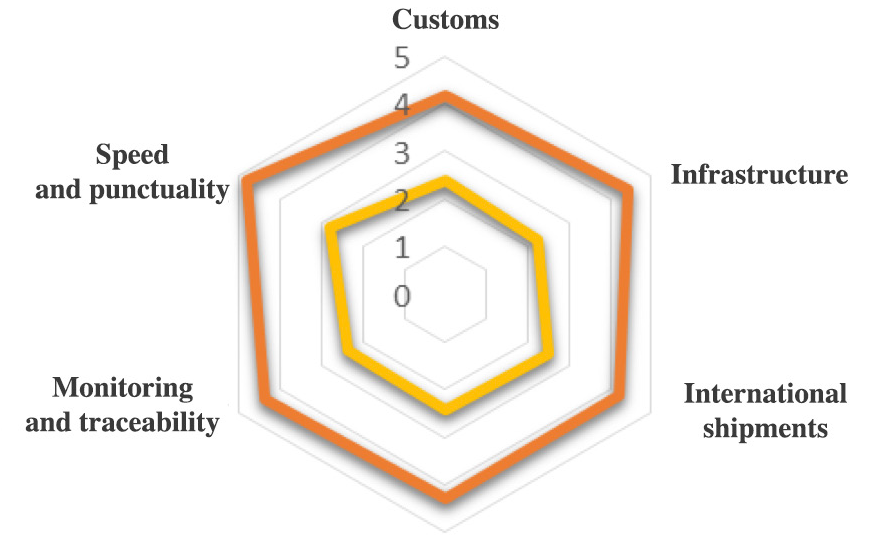

On these two levels, both infrastructure and logistics, the ECOWAS countries still have to invest heavily to meet the challenge of regional integration and improve their performance. Indeed, according to the results of recent surveys carried out by the World Bank and the World Economic Forum, ECOWAS countries are far from the maximum levels reached in these two areas (see Figure 5 and Figure 6). The first figure depicts that for each of the logistics performance components, the average of the scores obtained by these countries is nearly half the score obtained by the country with the best score. By focusing on infrastructure (Figure 6), it can be seen that, in general, countries remain at more or less intermediate levels vis-à-vis the maximum score (7). The Ivory Coast seems to be a good example of progress in all infrastructure components. As for customs procedures, the level of red tape is also at an intermediate level.

In short, given these results, the quality of infrastructure and logistics continues to be a major constraint to the development of the private sector in general and to cross-border trade in particular. It discourages trade and thus investment. Governments have an important - if not exclusive - role to play in improving the quality of infrastructure. This includes accelerating the implementation of regional plans to develop quality cross-border infrastructure. As for the private sector, it is mainly concerned with the development of logistics chains adapted to the sector. This is however conditioned by the establishment of a positive business environment by the state.

Figure 5: Levels of logistic performance in 2016

Source: World Bank Logistic Performance Index. Author calculations.

Figure 6: Infrastructure and Customs Quality Levels (best = 7)

Source : The Global Competitiveness Index 2015-2016 – World Economic Forum

Conclusion and implications

Agricultural growth and the new characteristics of the food economy provide growth opportunities for the sub-regional economy, which are conditioned, among other things, by improved trade facilitation. Despite the establishment of the institutional framework for this purpose, some challenges still need to be overcome in order for companies to take full advantage of the opportunities offered by the common market. The cost of agricultural trade in the Community is compounded by tariff barriers that are being dismantled, but also by a variety of non-tariff measures perceived as barriers by businesses.

Customs tariffs and informal payments create direct costs that increase food prices and affect the competitiveness of businesses. These problems must be tackled at the source by speeding up the compliance of individual countries with Community regulations. Monitoring and evaluation mechanisms can serve as an incentive for the effective elimination of tariffs. Similarly, state agents involved in informal payments (especially customs authorities) need to be more accountable and controlled in turn. The use of new technologies should also be used to minimize the role of the human factor in all commercial processes.

Other non-tariff measures perceived as barriers create indirect costs related to difficulty in compliance and / or procedural barriers. Moreover, the repetition of some of these measures on departure and arrival of goods is an aggravating factor. Considering the legitimacy of these measures, it is important to conduct strategies to reduce the perception by companies as obstacles. This involves (i) monitoring, empowering and improving stakeholder effectiveness in trade procedures to reduce processing times, (ii) improving bilateral and multilateral cooperation between the institutions involved in inspections and the issuance of certificates in order to eliminate repetitive or overlapping measures or procedures.

On the other hand, it is important to improve the access of farmers and processors to information on Community requirements (in particular the certificate of origin and its related procedure) and on the market. Market information must be equally accessible to both buyers and sellers. For this, mechanisms for exchanges of agricultural or food products may emerge. While several attempts to establish such types of an exchange have failed in Africa, the path to further south-south cooperation is key to the success of such a project because socio-economic contexts are similar. For example, ECOWAS could benefit from the Ethiopian experience in this area. Since 2008, Ethiopia has established a commodity exchange that is now a success, given the positive impacts on farmers' incomes, among other things. With a certain number of adaptations, this mechanism could emerge within the ECOWAS common market.

Finally, efforts must continue to improve the quality of logistics and infrastructure. Through investment incentives (tax incentives, improvements in the business environment, etc.), the private sector could develop and offer transport and logistics services that meet the requirements of food products. This is also an opportunity for South-South cooperation in terms of helping to set up incentive frameworks and investments in transportation and logistics. Infrastructure improvement efforts must be accelerated by exploiting new financing opportunities arising from changes in the international environment (for example, the emergence of new players such as the BRICS and their New Development Bank, the increasing Moroccan interest in the sub-Saharan region, etc.) and use of the poorly exploited potential of mobilizing domestic resources.