Food Trade Policy and the Dietary Transition

The irony facing many developing countries today is that increased food trade and the implications of globalization has created a situation where certain segments of the population are simply put, eating too much, while just in their proximity lies a more significant segment of the population who are suffering from the complete opposite, malnutrition. This policy brief aims at explaining this double sided sword.

A number of recent papers (e.g. Hawkes et al, 2009) have highlighted the emergence of a double burden of malnutrition in many developing countries. While large numbers of people continue to suffer from under-nutrition, receiving insufficient calories for their daily needs, many others now have excessive intakes of salt, sugar, fats and oils fat, contributing to obesity and predisposing them to non-communicable diseases such as diabetes and heart conditions. This is indeed a troubling problem, and one worthy of serious policy attention.

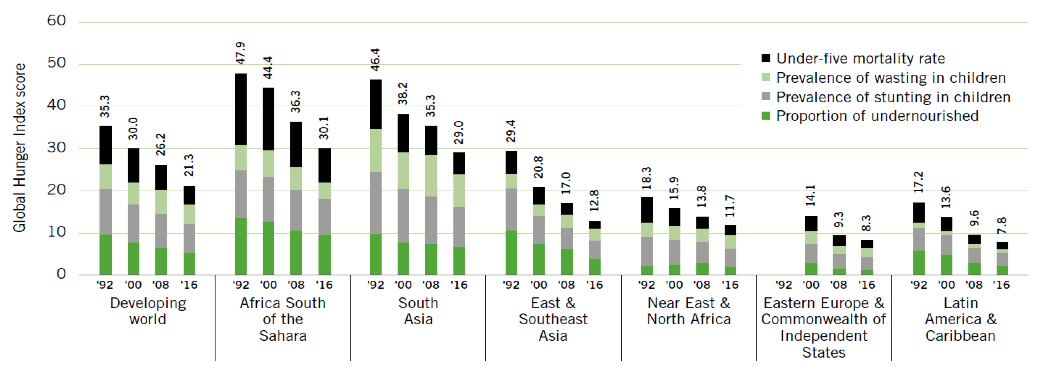

There has been substantial progress in the fight against under-nutrition, with the IFPRI Global Hunger Index (GHI) falling by 29 percent since 1992 (von Grebmer et al 2016). However, substantial problems of under-nutrition remain, some arising directly from lack of access to sufficient calories while others arise from poor utilization of those calories due to disease or poor sanitation. The GHI takes all these forms of undernutrition into account by aggregating standardized measures of undernourishment, stunting and wasting in children and the under-five mortality rate. Figure 1 shows that this index remains very high in the developing world at large and particularly high in the two regions that are home to the largest number of poor people--sub-Saharan Africa and South Asia.

Figure 1. The IFPRI Global Hunger Index—levels and evolution

Source: von Grebmer et al (2016, p11).

At the same time, and frequently within the same households, there are now substantial problems of overweight and obesity. A striking illustration of the extent of the global increase in obesity and some indications of its regional impacts are evident in Figure 2. This Figure, from Finucane et al (2011), shows the average rate of obesity among adult women in 1980 and 2008. It reveals extremely rapid growth in the proportion of adult women in Southern Africa suffering from obesity, to an alarmingly high level of over 30 percent in that region. The growth of the obesity rate amongst women has been even higher in the Middle East and North Africa and in Central Latin America.

Figure 2. Obesity rates among Adult Women,

Source: Finucane et al (2011)

In the extensive literature addressing the problems associated with the double burden of malnutrition, it is frequently argued that the problem of over-nutrition is a consequence of globalization and that policy should therefore address it using measures such as trade and investment policies designed to influence the relationship between the domestic and the world economy. Clearly, there are many cases where new and non-nutritious foods have been introduced by foreign firms—such as soft drink distributors or fast food chains. However, there are many other cases where foods rich in ingredients such as salt, sugar, fats and oils were part of the traditional diet. In this case, globalization may play a relatively minor role relative to income growth and the tasty nature of these products to consumers previously unable to afford much of them. Further, the simultaneous existence of both forms of malnutrition—under nutrition and over-nutrition—means that great care needs to be taken when designing policies to deal with these problems.

Much of the literature examining case studies of this problem—in Africa, Asia and the Pacific—concludes that this form of malnutrition results from globalization, and recommends policies such as tariffs based on the fat content of imported food that seek to offset these adverse impacts. Thow et al (2011) advocate interventions such as a tariff regime finely calibrated to raise the prices of high-fat foods. This conclusion appears to have been widely accepted in parts of the public policy literature, with the recent report of the High-Level Panel of Experts on Food and Nutrition security endorsing policies that use trade policies to influence consumption patterns (HLPE 2017, p95).

The argument of this brief is that there are important policy questions about how to deal with the very real problems posed by this form of malnutrition. But that the best policies for dealing with them are likely to be those that most directly target the problem, rather than policies such as trade and investment restrictions that are quite distant from the nutritional problem and liable to create collateral damage. In this view, it becomes much less important whether the problem results from globalization or from domestic changes. What matters is which intervention will best deal with the problem at hand.

A key policy question is why consumers would choose to eat foods that have such strongly adverse impacts on their health. Human nutrition is complex and people often make choices that are not in their long-term interest. New, tasty, energy-dense or ultra-processed foods, often heavily promoted, attract many consumers. The adverse health outcomes, such as obesity and diabetes, only become apparent with time. One likely cause of consumers’ choice of unhealthy foods—especially when they first become available—is lack of knowledge of these consequences. Another potential cause of such food choices is time-inconsistency, with even consumers who understand the adverse impacts of these food choices finding themselves unable to summon the willpower to restrain their consumption in the short run. Another problem may be advertising campaigns that prey on human weaknesses in decision making of the type identified by Akerlof and Shiller (2015).

Identifying the source of the nutritional problem is critical to selecting the right response. Such analysis has been done for related issues, including the health burden of some agricultural products, notably tobacco (Cummings 2002). This analysis may lead to a comprehensive set of policy recommendations designed to reduce consumption of foods with adverse health impacts, or to reduce the impact of such consumption. These policies might include education campaigns designed to influence the preferences that give rise to demand for these foods; price policies that reduce consumer demand without necessarily changing preferences; regulations on the composition of the product; and regulation of product advertising and/or packaging. The argument by Evans et al (2001) that providing information alone would not be sufficient to solve the dietary transition problems in Tonga and Fiji so that trade barriers are needed reflects a failure to consider the full range of available policy options.

An import restriction such as a tariff or a ban is comparable in its effect on consumption only to a consumption tax. Under textbook conditions, where the domestic and the imported good are perfect substitutes, and imports continue following the imposition of the trade policy, they would be expected to have the same impact on consumption. But there are several reasons to prefer the consumption tax over the import measure. The first is that, even under textbook conditions, the import measure is likely to stimulate domestic production of the good. If consumption of the good is undesirable, it seems an odd policy choice to stimulate its domestic production. Another problem with using import measures is that there are limits to how high they can push the price of the domestically-produced good. If imports are completely shut down, the domestic price of the good may end up substantially below the duty-inclusive price of the imported good. This is particularly the case if domestic goods can be produced by relatively simple transformation of upstream imported inputs subject to lower barriers, as occurred when trade policies were used in Fiji.

Taxes on consumption also avoid the need to investigate whether the proposed policy is consistent with WTO or other trade agreements. Any rate of consumption tax is consistent with WTO commitments, as long as it is imposed equally on domestic and imported supplies of the good. Avoiding the use of trade measures to deal with this consumption problem avoids the political complexities of dealing with WTO commitments, and diminishes a potential source of opposition to policy reform.

In many of the small-economy cases considered (see, for example, Thow et al 2011), there was initially no domestic production of many of the products considered. In this situation, an import duty and a consumption tax are initially equivalent in their administrative demands, with the levy collected only on imports. There is no administrative reason to prefer an import duty over a consumption tax in this case. There is also no political reason to prefer an import policy over a tax measure in this situation. If policy makers find it helpful, in their efforts to get policy action, to blame imported goods for the problem, they can still respond by imposing a consumption tax that will both deal with the problem and avoid creating incentives that will potentially undo the solution at a later stage.

Once we recognize the likely need for a comprehensive package of measures to deal with over-nutrition problems, another problem with using trade measures becomes clear. Policies that inform consumers of the adverse impacts of foods, or attempts to deglamorize their consumption, are likely to be easier to implement in the absence of a domestic producer lobby. Creating a domestic producer by imposing import barriers may later make it much more difficult to implement a more comprehensive and effective set of policies to reduce consumption.

In complex situations like these, the “assignment principle” states that we should target each goal with the policy that most directly affects it (McKinnon 1962). For example, to cut sugar consumption to reduce obesity-related diseases such as type-2 diabetes, we should focus on policies that directly address sugar consumption. If the problem is that consumers lack information about the effects of the good, then provision of information is likely the best policy. And if the good has addictive properties that make it difficult for people to give up, even when informed of its attributes? Perhaps consider taxes that will reduce the risk of people becoming addicted. Policies based in behavioral economics, that reduce the ability of marketers to use false or misleading approaches to attract customers, may also play a role. A comprehensive set of policy measures that target the problem directly is likely to be needed and trade policy interventions are likely to undercut the effectiveness of some of the suitably targeted measures.