The Future of Globalization

This brief reviews the main features of the recent globalization, attempts to explain its persistence over the centuries and why it is likely to persist in the indefinite the future, examines the causes and prospects of the new protectionism, and concludes by drawing policy implications.

I. Features of the Recent Globalization

The recent history of globalization is well known: in the post-war era, we saw a big advance in global economic integration. Since the fall of the Berlin Wall, the process accelerated further, and this was reflected in several statistics: most importantly, the share of trade of goods and services in world GDP increased from less than 40% in 1990 to 60% today.

Meanwhile, the share of global Foreign Direct Investment in GDP has trebled; the share of international capital flows to developing countries in their GDP has increased by 2/3; and international tourist arrivals have trebled over the last 20 years.

Based on UN statistics, the stock of permanent migrants as a share of world population has not increased markedly in past decades although I am not sure how much I trust these numbers given the difficulties in documenting the movement of workers. Certainly, the numbers vary greatly across continents and while absolute numbers of migrants residing in developing countries have not changed much, in advanced countries they have increased quite rapidly. For example, the number of immigrants has doubled in the United States and Germany since 1990, nearly trebled in the United Kingdom, more than trebled in Italy and quintupled in Spain. Although the United States is traditionally viewed as a country of immigrants, only 14% of the US population was born abroad, a share not dissimilar to that of France and Germany today. The rise of migration into advanced countries has been reflected in the official tally of migrant remittances, which is also probably underreported. According to official statistics, the money that migrants send back home has doubled since 1990. These transfers of foreign currency helped significantly reduce poverty and helped finance domestic investment as well as the integration of many developing countries into world trade.

This takes us to another prominent feature of the recent globalization. Developing countries, which already account for about 80% of the world’s population and whose share is rising, have become full participants in the process, and are today its main drivers along numerous dimensions. China is now the world’s largest exporter and the largest economy in PPP-adjusted GDP terms and India is the third-largest, with the United States occupying second place. Developing countries now consistently account for about two-thirds of the world’s GDP growth, and trade amongst them (South-South trade) represents the fastest segment of world trade. The rise of developing countries is driven by demographics and a technological catching up process that is still very young. It is a process which -barring a cataclysm – is likely to be with us over the next few generations.

The integration of developing countries in global markets has been associated with a reduction in the number of absolute poor (defined as people unable to obtain adequate nutrition and shelter) from 1.85 billion in 1990 to 767 million in 2013 according to the World Bank. It has also been associated with the rise of a vast new middle class, opening new markets for companies in the high-income countries, and, increasingly, for global companies from other developing countries. The exports of goods of high-income countries destined to developing countries grew by 11% a year in current US dollars between 1990 and 2007, the peak year prior to the financial crisis, a rate 5% faster than their exports to other high income countries. Since 2007, while the exports of high income countries to other high income countries have declined marginally, the growth of their exports to developing countries continued to grow, albeit at the far slower rate of 3.5% a year. For the first time, developing countries, especially China, were large and dynamic enough to help mitigate the slowdown in advanced countries to a modest degree. However, developing countries, especially China, have continued to run a sizable trade surplus with advanced countries, and in the process of becoming integrated into global markets, created intense competitive pressure on all businesses that are intensive in unskilled labor and that are exposed to global markets, which I will come to later.

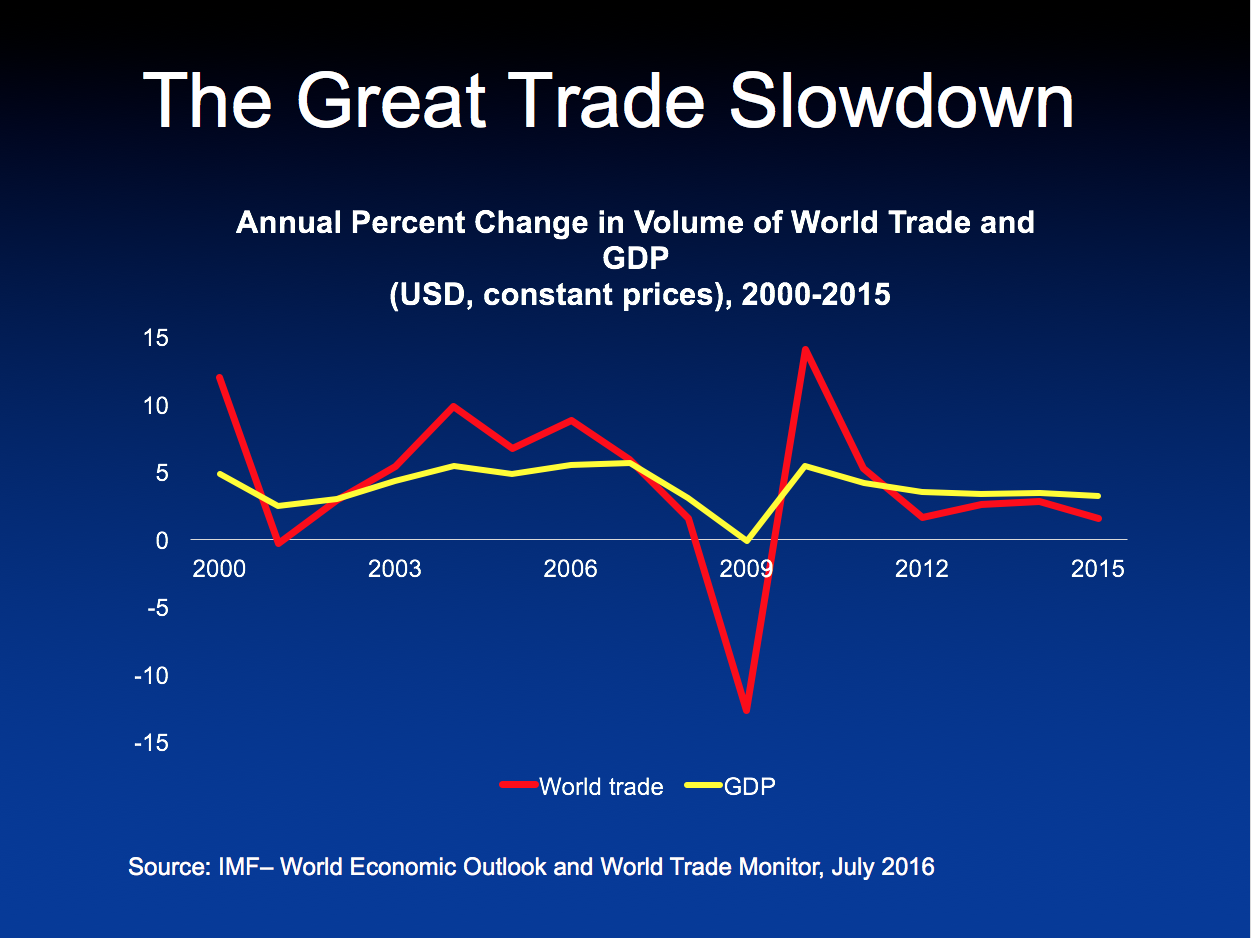

Arguably the most important single indicator of globalization – world trade - has slowed sharply since the financial crisis of 2008-9 – from growing twice as fast as GDP to growing at the same rate as GDP, leading some to believe that this marks the end of globalization – the “peak trade” theory.

This view is mistaken in my view. What is true is that the growth of world trade prior to the crisis was temporarily boosted by a hundred-year positive shock, namely the entry of China and other developing countries into the world economic mainstream, and that this is not going to repeat. What is also true is that there has been a marked slowdown in the growth of population across the world. The slowdown in the world population of working age is expected to persist, and this spells lower GDP as well as lower trade growth.

It is also possible that the advances in automation and labor-saving techniques of recent years (see below), and the need to respond quickly to changing markets, have in some instances made offshoring less attractive than keeping activities at home. However, the biggest reason for the slowdown in trade is cyclical, not structural. The financial crisis had a disproportionate depressing effect on investment and on the demand for consumer durables, which rely heavily on trade for both markets and for parts and components. And there is little evidence so far that the deceleration of world trade is due to any significant degree to protectionist measures.

In February of last year, Mc Kinsey issued a report on digital globalization that should help put the idea of “peak trade” to rest. They show that the amount of cross-border bandwidth used has grown 45 times since 2005, and project that – while it will not sustain this extraordinary rate of advance - it will increase 9 times over the next 5 years. They estimate that about 12% of global goods trade is carried out on e-commerce platforms which until recently did not exist. They estimate that cross-border data flows enabled resource reallocation and increased productivity that may have added 3-4% to world GDP over the last ten years.

With the economic recovery (see below), trade will accelerate again, even though it is unlikely to match pre-crisis growth rates on a sustained basis. Per the most widely followed statistics on world trade, issued by the Dutch Planning Bureau, world merchandise trade volumes grew at the annualized rate of 10% in Q1 2017. The IMF’s most recent forecast was released in April. It calls for a return to world GDP growth of 3% (measured at market exchange rates), which is in line with the pre-crisis 25-year average and for world trade growth of 4% in 2017 and 2018. The global financial crisis, the biggest economic shock since the 1930s, caused trade to slow, but did not stop the advance of globalization in its many dimensions. In the next section, we delve a little deeper into the reasons why.

II. The Persistence of Globalization

The forces that are driving globalization are fundamental and – in the long run – have proven to be stronger than the forces resisting it. It is possible to trace modern-day globalization back to the improvements in navigation made by the Chinese and Arabs starting in the 11th century and which eventually enabled the feats of European explorers – most notably Ferdinand Magellan, who died circumnavigating the globe in 1521 and who can claim to be the first globalist. Europeans may not have held a monopoly on globalization even then. There is, for example, a controversial claim that the Chinese explorers Zheng He, who sailed across the Pacific in 1425, and not Christopher Columbus, may have been the first “discoverer” of America.

An examination of the ebb and flow of globalization over the centuries suggests that we should think of globalization as driven by 3 forces: markets, technology, and states. Markets and certain types of technology, namely transport, information and communications technologies, almost invariably tend to spur globalization. States, on the other hand, blow hot and cold, but in the end, they adapt to it, often reluctantly.

Markets are the most important drivers of globalization. As consumers look for low prices and variety, businesses look for customers and lower costs, and investors look for higher returns and diversification, they do not stop at the border. And people – when faced with limited opportunities – seek to make a better living even if this means moving thousands of miles from home. Globalization can thus be viewed as international arbitrage in the market for goods, services, capital, and labor. History has shown repeatedly that when barriers are erected to thwart this arbitrage, people constantly look for ways around them, and eventually they find a way. In extreme cases, they do so by overthrowing the regime that imposes the barriers, such as when the resistance to Britain’s Navigation Acts helped trigger the American Revolution in 1776, and people across Eastern Europe and Russia revolted against communist regimes in 1989-90. To be sure, these episodes were motivated by the quest for dignity, personal freedom, and self-determination, but economic hardship and the prospect of improving one’s lot also mattered.

Transportation and Information and Communications Technologies are vital for globalization because they lower what economists call “trade costs”, and thus enable arbitrage. When – as in the time of David Ricardo - globalization was about exchanging cloth for wine, the falling costs of sea and land transport were key; but as globalization increasingly took the form of the sharing of tasks, trading services and operating complex international value chains which require just-in-time delivery, ICT became the driver.

What about States? States pursue their interests as they interpret them, and that means they follow ideas. Sometimes these ideas are sound and sometimes they are not. John Maynard Keynes wrote:

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist”

And, in a less optimistic vein, he continued:

“Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back."

Ideas matter. In a landmark article, Kenneth Arrow, the Nobel Prize Winner who died earlier this year, demonstrated mathematically Adam Smith’s conjecture that under quite general assumptions, free markets lead to an efficient allocation of resources, in the sense that they lead to allocations where one cannot increase the welfare of any one person without reducing someone else’s. This mathematical conclusion is just as true at the level of the world as it is at the level of a remote village that subsists in isolation. However, the arbitrage opportunities at the level of the world are far greater than they are at the level of a village and greater even than at the level of a large economy such as the United States. Numerous empirical studies, many of them carried out at the World Bank, have shown that international trade is positively correlated with economic growth in various ways: for example, countries whose exports as a share of GDP are high, tend to grow faster; and no country has grown rapidly and sustainably without growing exports.

Yet, despite the weight of the empirical and theoretical evidence in support of the economic benefits of globalization, history shows that states can stop globalization in its tracks for shorter or longer periods and they have often done so. There are many examples from the ancient world one could cite. China, for example, was the world’s largest economy already in the 15th century before it turned inwards. In recent history, globalization was stopped when the US Congress raised tariffs from their already high levels under the Smoot-Hawley Act amid the Great Depression. Tariffs on dutiable goods reached 60% and in the following years, as other countries retaliated and the depression deepened, US trade declined by 40%. Globalization was stopped with the outbreak of the Russian Revolution in 1917 and when the Iron Curtain was drawn around Eastern Europe in 1945 and until it was withdrawn in 1989. The Import-Substitution era in India between 1949 and the early 1990s cut off hundreds of millions from global markets. And the Cultural Revolution in China between 1966 and 1976 further deepened the nation’s pre-existing isolation.

Viewing states as institutions able to turn the G switch on and off, as I have done so far, is to look at them through too narrow a prism. For globalization to work, it is not enough for states to allow it and stand back. States must play an ongoing supportive role in globalization. They must establish four conditions: peace and security (if peace breaks down, as happened across much of the world between 1913 and 1945, or if security breaks down as during the Arab uprisings of 2011-2012, so does globalization); freedom of movement of goods, services, capital and people; conformity of rules and regulations across and behind borders; and provision of public goods that cut across a region, such as the road and rail infrastructure, or the world, such as governance of the radio spectrum and of the internet. Establishing these four conditions is hard, and to establish them, states must collaborate; indeed, most states today are continuously engaged in negotiations with other states to make globalization work, even if they are not always aware that is what they are doing. The current era is one of relative absence of international conflicts, yet there are quite a few examples of neighboring states that coexist but do not collaborate, and where, consequently, economic integration among them is minimal.

If there is one thing that the episodes of on and off globalization teaches us, it is that in the end the forces of markets and technology prevail over the isolationist state – even if it takes a lifetime as it did in Soviet Russia. Today, the North Korean state is notable for isolating its people from global markets. North Korea produces nuclear weapons and spends 23% of its GDP on defense but is one of the world’s poorest countries. By contrast, South Korea is one of the world’s most successful globalizers, has achieved high income status and spends only 2.7% of GDP on defense. Does anyone believe the North Korean in the street doesn’t know or knows but does not care? And is anyone willing to bet that situation will persist indefinitely? So, in the long run, the three forces of globalization, markets, technology and states, will almost certainly ensure that globalization remains.

But this is about the long run, and Keynes said that in the long run we are all dead. As a business executive said recently in a trade conference I attended “I understand what Keynes said. I just want to make sure I don’t die this week.” This takes me to the present difficulties.

III. The Present Challenge to Globalization

What accounts for the new protectionism? What makes the President of the United States, the world’s wealthiest economy by most measures and the architect of the Post-War system, say in his inauguration speech:

“For many decades, we’ve enriched foreign industry at the expense of American industry; …and spent trillions of dollars overseas while America’s infrastructure has fallen into disrepair and decay. We’ve made other countries rich while the wealth, strength, and confidence of our country has disappeared over the horizon. One by one, the factories shuttered and left our shores, with not even a thought about the millions upon millions of American workers left behind. The wealth of our middle class has been ripped from their homes and then redistributed across the entire world.”

How does Marine Le Pen of the National Front, once the outcast party, obtain 1/3 of votes in the French Presidential election? And why do right-wing nationalists come to prevail in Hungary, Poland, and pose a serious challenge in Austria and the Netherlands? What causes Britain to elect to leave the European Union?

There is a dark side of the force of globalization. The most important aspect in my view is the disruptive effect of globalization on less-skilled workers in the United States and in other advanced countries. Blue-collar workers in garment and shoe manufacturing companies have experienced the new international competitive wave more directly than have waiters or porters. However, the market for unskilled workers – like any other market - is in general equilibrium, so the wages of waiters and porters have also been depressed as opportunities for unskilled workers in the manufacturing sector declined.

In addition, and this is almost certainly the more important factor, labor-saving machines – predating the computer by centuries but greatly enabled by ICT innovations – and spurred partly by the new competition from low-wage countries – have spread. Consequently, vast segments of unskilled or semi-skilled labor, whether or not exposed to international competition – for example bank tellers and more recently shop attendants and in the future quite possibly truck- and taxi-drivers – are displaced or displaceable by machines. The phenomenon of “skill-biased technological change” has been studied extensively. According to a recent comprehensive study of job content and automation potential by McKinsey, almost one-fifth of the time spent in the workplace in the United States is highly automatable using known technologies, as it represents physical work and operating machinery in a predictable environment. Innovations such as machine learning (one aspect of artificial intelligence), the internet of things, soft robotics, and autonomous vehicles have greatly expanded the capacity of machines to carry out tasks previously thought to be exclusively the domain of humans. According to the study, another one-third of worktime in the United States is spent on data collection and processing, and most of that work is also automatable using known technologies.

The outsourcing of many jobs, such as call centers and order processing, to low-cost location is a relatively recent phenomenon. It is made possible by ICT, the increased ability of developing countries to host these activities, and the willingness of advanced countries to allow it. Outsourcing is just one aspect of the de-laboring process in advanced countries, and certainly not the most important one. While it creates jobs in poor countries, it adds to the competitive pressures on unskilled or medium-skilled workers in advanced countries.

One result of these forces is that American unskilled workers, especially white men who populated factories 20 or 30 years ago, make less now than they did then, inflation adjusted. Similar trends are evident in most other advanced countries, although in some where labor markets are less fluid, for example France, the phenomenon is reflected in unemployment rather than in wages. However, France has an extensive safety net and a single-payer health-care system, whereas the US does not. In the US, the life expectancy of white men who are high-school drop outs was 67 in 2008, down from 70 in 1990. According to a recent Brookings study, the mortality rate for Whites with high school or less, aged 50-54 has shot up from over 700 per 100,000 to over 900 per 100,000 since 2000, and is now much higher than that of Blacks and Hispanics. Angus Deaton, the Nobel Prize winner who co-authored this study calls them “Deaths of Despair”. Based on the GINI coefficient and on shares of different income percentile, the United States has become the most unequal advanced country after Israel, reaching levels of inequality not very different from those in developing countries such as Mexico.

While economists and many politicians prefer to separate the effect of trade and the effect of technology, arguing (quite correctly in my view) that the decline of wages of unskilled workers is due more to the latter than the former, the distinction hardly matters to those who lose their job. What is more, technology and trade clearly feed on each other, and so it is very difficult to parse their consequences. There is little reason to believe that the technological trends causing increased inequality are about to change course. However, while no-one seriously believes that nations can, or even should, stop technology, many believe that trade can and should be restricted.

How does all this play out in politics? As Augusto Pinochet’s Chile and Lee Kwan Yew’s Singapore showed, states don’t have to be democratic to succeed in globalization – at least for a while. However, in a democracy such as the United States or France, the willingness and ability of the state to engage in globalization depends crucially on the social and political consensus that underpins it. If the social consensus in support of globalization becomes frayed, or if a large part of the population turns against it, then democratic states backpedal. However much the elite, international firms and international institutions may believe in globalization, democracies tend to respond to the will of the masses. The electoral maps of the recent U.S. and French Presidential elections separate quite neatly into geographies that have performed well economically, which voted for the centrist candidate, and those that did not, which voted for the populist candidate. When President Trump withdrew from TPP during his first days in office, an agreement that had taken 12 countries across three continents ten years to negotiate, and when he threatened to brand China a currency manipulator, withdraw from NAFTA and from the WTO -all of which he has so far been deterred from doing - he was interpreting what he saw as the will of the masses that elected him.

Rising individual and regional inequality caused by technology and by globalization provides only part of the answer to what caused the new protectionism. An interesting analysis of recent election outcomes by the Barclays Investment Bank highlights another important cause, namely a growing concern about the loss of sovereignty to super-national institutions such as the European Union, the WTO, and to far-reaching and deep trade agreements such as the now discarded Trans-Pacific-Partnership.

Of course, these concerns are not new: inequality and concerns about eroding sovereignty were with us 20 years ago, and even further back, when the resurgence of right-wing nationalism and protectionism was still only nascent in most countries. What is new is the grave effect of the global financial crisis, its spillover into a long-brewing Euro-crisis, and the glacial pace of recovery from both. These crises established the perception – correct or not – that policy-makers (“the elites”) were not only incompetent but that the choices they made, such as first deregulating and then bailing out the banks, were self-serving if not outright corrupt. EU enlargement to the East is also quite new, and it led to a surge of European migrants into the UK – widely believed to be the most important grievance of those who voted for Brexit. The recent instability in the Middle East, caused in part by misguided foreign interventions, gave rise to radicalization, and was followed by a wave of conflicts, atrocities and terrorism. This led ultimately to the mass movement of refugees. In Europe and the United States, these events contributed to the legitimation in the eyes of some groups of ideologies that are ostensibly nationalistic, but at their root are racist and religiously intolerant. These disparate forces reinforced each other, and all contributed to an accumulation of grievances.

Despite all this, the political center continues to hold. The most recent developments are, dare one say, reassuring. Emmanuel’s Macron’s victory in the French election, the victory of moderates in Austria and the Netherlands and of Angela Merkel, Europe’s veteran political leader and its most steady hand, in the North Rhine-Westphalia local election, have dispelled fears that centrifugal forces would gain the upper hand in the European Union in the wake of Brexit. Perhaps most important, Donald Trump’s protectionist intent has so far been checked by the Republican majority in Congress, by the fear of retaliation against farm exports and other powerful interests, and by the need to work with China to contain North Korea and with Mexico to police the Southern border. We see that, once established, global economic integration is not easily reversed. Powerful business groups, from retailers, to importers of parts and components, to exporters, have developed a large vested interest in open markets. For example, consumer groups, retailers and oil refiners have lobbied furiously and, so far successfully, against the imposition of a border adjustment tax.

Yet the persistence of pressures from technology on the less-skilled workers as well as from increased low-wage competition, should discourage any sense of complacency. It is important to note that if the planned US tax cuts and increased infrastructure spending go through, the US is headed towards larger, not smaller trade deficits, the likely harbinger of even greater trade frictions. And certainly, current US policies are not helping tackle inequality. Cutting taxes on capital gains and dividends and on high incomes and reducing health coverage will only add to the grievances of those that have been most affected by the trends we have discussed. We are not out of the woods yet.

IV. Implications for Policy and Conclusion

Most businesses engaged in international trade, even small and medium sized enterprises, have a voice in public policy either directly or through trade associations. In their advocacy, firms should impress on policy-makers that – contrary to the protectionist narrative that depicts trade as the great job destroyer – their ability to grow, pay taxes, and generate jobs, depends on open markets. Trade protectionism not only raises the cost of inputs and prices for consumers, but also invites retaliation and so represents a threat to exports. In a trade war, the ability to operate as part of global value chains, and to sell overseas is compromised. Restrictions on movement of people, whether of temporary workers and executives, or of permanent migrants, hinders the efficiency of firms and provides an advantage to competitors overseas who are not so hindered. Firms have invested heavily in global production networks on the premise that international trade remains open and predictable. The value of these investments would plummet if trade is threatened. In an extreme scenario, protectionism could force some firms that depend on international markets to relocate their activities to be close to their largest markets abroad, instead of increasing employment at home.

Protectionism is a particularly anomalous course to take for the United States, the world’s most productive economy. The United States consistently ranks at the top of any number of measures of the competitiveness of nations, is well positioned in the industries of the future, and is currently at full employment. The obsession with bilateral trade deficits makes no sense in an integrated global economy; instead, more attention should be paid to the deficiency of national savings – including the budget deficit – which is the root cause of the nation’s long-standing aggregate trade and current account deficit. The deficit is much smaller than it used to be, reflecting improved household savings and the energy wealth created by new shale oil and gas technologies. As in the past, the current account deficit also reflects the United States’ attraction as a destination for foreign investors who still consider it as the ultimate haven

That is not the end of the story. Certainly, businesses should insist on open borders, but they should also be asking what more businesses and the government can do through social policy to mitigate the disruption and large inequalities. Globalization should not be allowed to become a zero-sum game, at home or abroad. If giant retailers such as Wal-Mart and the global restaurant chain McDonalds can decide to raise their wages above the legal minimum, then perhaps smaller firms that can should do so too. In the United States, business interests are pushing for a large cut in the corporate tax rate. The official US corporate tax rate is, at 35%, high by international standards, but, because of generous exemptions, the actual corporate tax take is not far out of line of that in other advanced countries. But should business insist on tax cuts if they mean either large budget deficits or cutting social spending? In the United States, one plan under consideration to “pay” for tax cuts would eliminate health care provision for tens of millions. Yet, provision of universal health-care, investments in education, and a progressive tax structure are the core policies needed to remedy the marginalization of those most likely to oppose globalization.

Beyond stepping up their advocacy in favor of open markets and of policies that protect the vulnerable, how should businesses reposition their businesses in the light of the new protectionist risks? Under a protectionism scenario, which could turn into a protracted trade war, there will need to be a major review of production and service chains to privilege locations in the same customs territory as the consumer or client. Given the importance of the United States as a market for American firms, of Germany for German firms, etc., this may mean a significant reshoring for many businesses. But even if trade frictions escalate I, for one, would not want to bet on this state of affairs becoming permanent.

As of today, the continued globalization scenario appears the more plausible outcome. It is tempting to conclude that, even in the more benign scenario, American businesses should respond to the Trump administration’s entreaties by holding back on foreign investments and reshoring important activities, as some have done, and that firms across the world should respond similarly to the call of their own governments. I believe such responses to be misguided. First, because it is unlikely that such a course is sustainable in business terms. Second, because policies may change again. No-one knows for sure, but it is quite possible that that the next election will bring about yet another change in direction. Third, because these costly accommodations could encourage even greater demands. There is a time for pragmatism but there is also a time when a polite “no” is the best course.

In summary, this brief has argued that we are not witnessing the end of globalization and that the most likely scenario is that it will persist and possibly even accelerate in future years. Still, decision-makers should not underestimate the risk of a big escalation of trade frictions. They should be more pro-active in their advocacy in favor of open markets and of social policies that are supportive of the losers from globalization.