The Role of a Flexible Foreign Exchange System in Macroeconomic Adjustment: The Case of Morocco.

Morocco has moved towards a more flexible exchange rate system by widening its currency fluctuation bands to +/- 2.5% around a central price. This transition will, in time, equip the Moroccan economy with a macroeconomic instrument acting as a shock absorber and facilitating rapid adjustment at lower costs. In the absence of such a mechanism, adjustment to macroeconomic shocks at times requires a contraction in demand and thereby a cyclical downturn in growth to restore external balances. Broadening the fluctuation bands is a first step towards a long-term managed floating regime that nevertheless gives the central bank an important role in smoothing out exchange rate fluctuations.

Morocco announced the transition to a more flexible exchange rate system, with currency fluctuation bands of +/- 2.5% around a central price determined by the central bank on the basis of a basket of currencies consisting of 60% Euro and 40% Dollar. This decision, put in place officially as of 15 January 2018, is a first step towards ending the fixed exchange rate regime in place since Moroccan independence. At the operational level, the central bank no longer operates under an open window system, where all economic agents' requests are met at a fixed rate. It now operates through the purchase and sale of foreign currencies by auction, allowing the development of an interbank foreign exchange market. The last exchange rate reform was carried out on 15 April 2015, when authorities altered the dirham's basket currency weights to best reflect foreign trade structure.

Arguments for a more flexible exchange regime

A more flexible exchange regime implies that domestic currency supply and demand (as a counterpart to other currencies) have a role in determining exchange rates, albeit within fluctuation band limits, which in the domestic case, remain narrow. Economic and financial relations between residents and non-residents, captured through the balance of payments, materialize supply and demand. Foreign exchange inflows, generated from exports of goods and services, remittances from Moroccans residing abroad or foreign direct investment (FDI), lead to an increase in domestic currency demand, while imports of goods and services and debt service repayment, for example, lead to an increase in foreign currency demand.

Proponents of flexible systems argue that these absorb external shocks spilling through to the domestic economy and serve as a self-regulating stabilizer. Absorption is defined as allowing an exchange rate movement in one direction or the other to mitigate the impact of an initial shock on real economic activity. A fact-based approach provides a better understanding of how this mechanism works. Indeed, when exchange rates are fixed, a decline in foreign demand leads to a decline in exports and domestic production and, consequently, in employment. In this case, adjustment can be costly and impact real economic activity and labor markets. One can nevertheless conceive of a less restrictive adjustment, if prices and nominal wages were technically flexible. Obviously, prices and nominal wages tend to be particularly rigid downwards. Very few labor market structures tolerate nominal wage flexibility, especially downward, in the face of any shock. Thus, a fixed exchange rate, combined with generally downwardly rigid prices and wages means that, in the presence of adverse external shocks, domestic export prices, expressed in foreign currency, remain unchanged and competitiveness, at least in the downward phase of the cycle, leads to a contraction in output and employment.

Conversely, in a floating exchange rate system, adverse shocks to foreign demand lead to a proportional depreciation in the domestic currency and, hence, export prices adjust downwards, thus preserving cost competitiveness. Not only are exports unaffected, but imports rise in price and domestic demand is directed towards domestic products for a shift in relative prices. In other words, the price ratio between domestic and foreign goods and services adjusts in a flexible exchange rate context, while it is output that is impacted by the shock in a fixed exchange rate context. This type of exchange rate system is however often associated with higher levels and volatility of inflation. It is important to stress that such mechanisms do not operate perfectly according to the logic explained, but are subject to imperfections due to market structures and to substitutability among domestic and foreign goods.

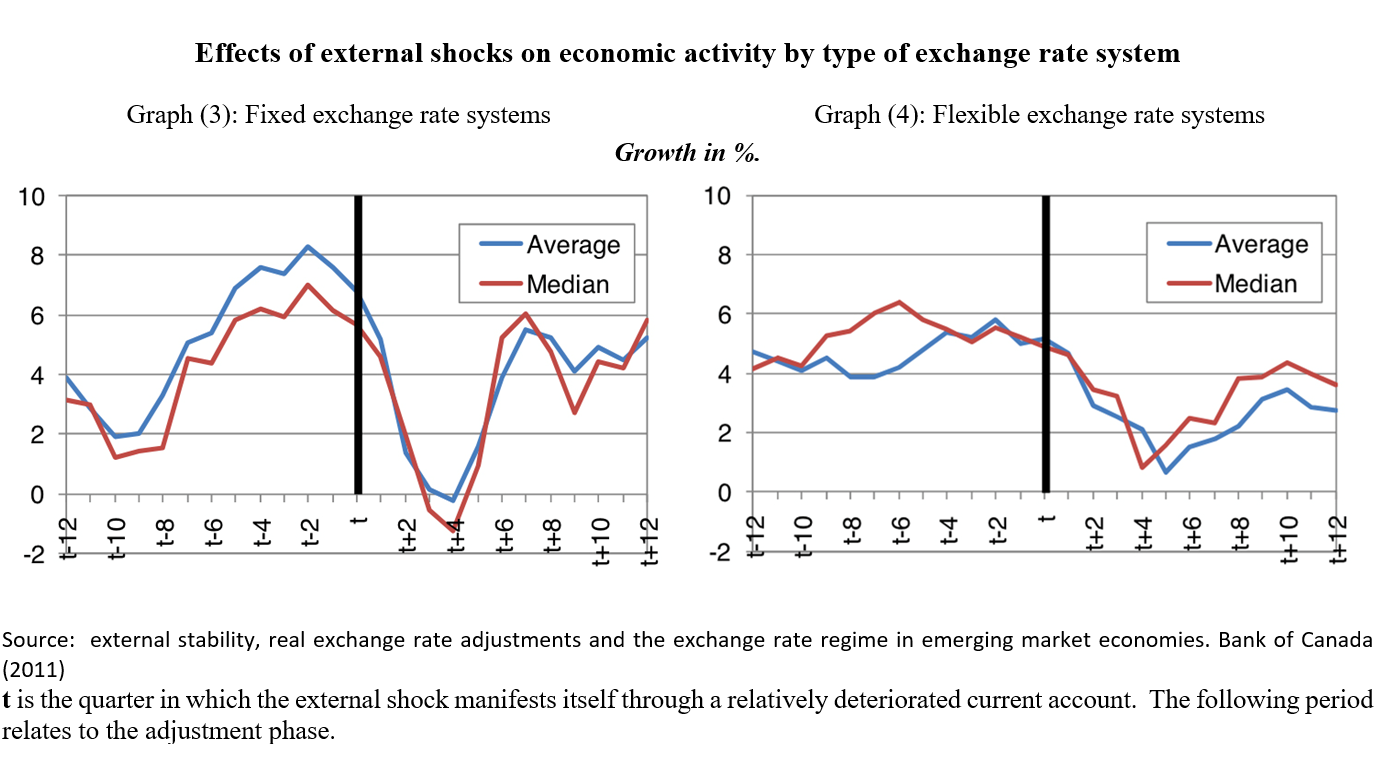

Empirical studies confirm that flexible exchange rate systems allow economies to adjust at lower costs than fixed regimes. Gervais, Schembri, and Suchanek (2011), in a paper published by the Bank of Canada, confirm the optimality of flexible exchange rate systems. Using a sample of 22 emerging economies, they demonstrate just how much lower adjustment costs in the face of an external shock are in a flexible exchange rate system than in a fixed one. They also point out that shock absorption properties under flexible systems are not perfect, since the transmission of shocks to real economic activity is only partially absorbed. There is, however, no consensus among economists on the conclusion of this work, and research results remain sensitive to both sample and period of study. More recently, a study by Pancaro (2016), published by the European Central Bank, highlighted the absence of empirical links between adjustment costs in the face of an external shock and exchange rate systems in place, on a sample of developed countries.

In addition to shock absorption properties, flexible exchange rate policy provides central banks with more flexibility to conduct independent monetary policy. Monetary policy is thus more autonomous in meeting initially established objectives and in defining monetary conditions best suited to domestic macroeconomic conditions. It should be noted that the monetary policy framework provides a certain latitude for the central bank in Morocco. Imperfect substitutability between domestic and foreign capital markets, leading to lower volatility, especially in short-term capital flows, allows the central bank to define monetary policy, independently of the monetary policy stance of the European Central Bank and the Federal Reserve.

The dirham's exchange rate in the face of external shocks

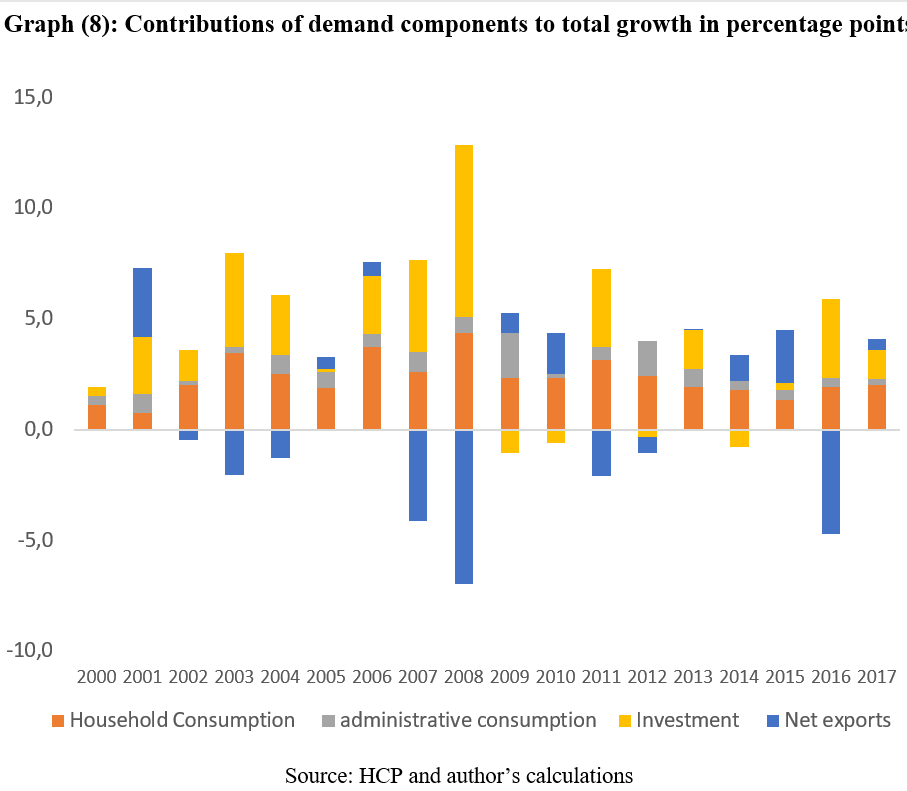

The 2008 crisis provides an insight into the role an exchange rate system can play in absorbing shocks. Indeed, the world economy plunged into severe recession, with a 1.7% contraction in activity for 2009. Similarly, the Moroccan economy saw a deceleration in growth in non-agricultural activities from 4.5% in 2008 to 1.6% in 2009. The analysis of the contribution of various demand components shows the importance of exports of goods and services in this contraction, dropping by 9.2% compared to 2008. By sector, tradable activities such as mining and manufacturing fell sharply, reflecting the impact of challenging international conditions on domestic activity.

The graph above shows the evolution of Real Effective Exchange Rates (REER) over a number of periods, including 2007-2009. The sample of countries includes middle-income economies not highly dependent on commodities and with exchange rate systems more flexible than that of Morocco. The classification of exchange rate systems used is that developed by Reinhart and Rogoff (2017). The choice of the 2007/2009 sub-period is motivated by shock severity, persistence and, above all, its’ almost synchronized effect on all world economies. Moreover, economic activity in all countries of the sample experienced either contraction or a slowdown in the pace of growth.

One first question to be addressed, in the graph and analysis below, is the selection of Real Effective Exchange Rates (REER) over Nominal Effective Exchange Rates (NEER) . Indeed, adjustment via nominal exchange rates may in some cases, not lead to expected results and can be understood as an increase in domestic prices to mitigate and even offset exchange rate movements. Generally, emerging economies with more flexible exchange rates experience higher levels of inflation, while economies with fixed exchange rates are less exposed to significant price fluctuations. In addition, REER accounts for the degree of price and implicitly wage rigidity, which sometimes differs from one economy to another.

Over the 2007-2009 period, most sampled countries saw a real depreciation of their currencies as an automatic response to gloomy global economic conditions. This depreciation was even more pronounced in nominal terms. Countries such as Albania, Turkey and Ukraine saw their currencies depreciate in real terms, in line with the effects of the crisis, while they had appreciated throughout the period leading up to the shock. Conversely, the dirham's real purchasing power increased, penalizing growth at a time when the economy needed a recovery to support net exports.

Since then, external shocks proliferated and continued to impact the Moroccan economy. The surge in oil prices, among other things, led to current account deficits of nearly 10% in 2012. By its sheer size, financing this deficit could not be provided through FDI inflows of around 3% of GDP, nor through external public debt. Thus, a major drawdown on foreign exchange reserves occurred between 2010 and 2012, dropping drastically by 27% and reducing the reserve to only 4 months' imports of non-financial goods and services. Such pressure on reserves could jeopardize the sustainability of the fixed exchange rate system, as it depends on the stock of foreign reserves available to the central bank. Depletion means that the central bank can no longer stabilize dirham prices against foreign currencies. Several economies in Southeast Asia and Latin America found themselves in similar situations and had to allow their exchange rates to float for lack of reserves to protect the exchange rate parity set by the Government. Thus, Morocco's exchange rate system did not allow the "price of the dirham" to adjust to such developments, with the NEER in virtual stagnation from 2010 to 2012. It is, in fact, the inflation differential in relation to economic partners that benefited the Moroccan economy and led to a real depreciation of 4.7%, which remains somewhat contained considering the magnitude of the shock.

Implications of fixed exchange rate

From 2013 onwards, the Moroccan economy embarked on a phase of forced adjustment to restore overall macroeconomic framework viability. In addition to external imbalances, the Treasury's financing requirement reached 7.4% of GDP. The priority was to restore macroeconomic balances, both internal and external. Under these conditions, the Dirham saw its purchasing power increase in real terms, whereas the adjustment may have led to depreciation. It thus appears that economic activity was impacted and suffered the costs of adjustment. It is sufficient to recall that non-agricultural growth stabilized at lower levels, falling by 1.8 percentage points between 2012 and 2013.

This decline in long-term growth is largely attributed to structural factors. Cyclical dynamics linked to the adjustment of domestic demand are nonetheless also at the root of the economic slowdown. The government, as supported by the data, embarked on a relatively restrictive policy. Investment by the Treasury and Public Enterprises and Institutions fell from 15.3% to 14.1% of GDP in 2013, the year in which the government decided to stop the execution of 15 billion dirhams initially allocated for investment. This 1.7% of GDP budget cut is virtually equivalent to the 1.8 percentage point of lost growth between 2012 and 2013. It is also clear that from that date onwards, public investment returned to a lower path hovering around an average of 13.8% of GDP. Moreover, when analyzing final demand by component, the contribution of general government consumption to total growth declined from 2013 onwards, averaging only 0.5 percentage points of growth, while between 2000 and 2012 it stood at 0.8 percentage points of growth.

The downturn in international commodity prices, particularly oil prices, was also a significant factor in domestic adjustment strategies, and much of the external deficit decline from 2014 onwards is attributable to this nominal dimension. The adjustment would likely have been more costly in another scenario where oil prices would not have fallen. It is important to note that the consolidation of public finances was unavoidable for the government in such unfavorable circumstances, in a situation reminiscent of the fiscal slippage period preceding the structural adjustment program.

In a flexible exchange rate system that would have pulled the Dirham down, the private sector would have been forced in turn, to curb demand for imported products, and the pressure on the domestic productive fabric geared mainly towards exports, would also have been relieved by - at least cyclical -price competitiveness gains for ultimately a less costly economic adjustment in terms of growth.

A gradual transition towards a managed floating system

This reform is only the first step in a long-term process, driven by the desire to provide Morocco’s economy with a long-deactivated macroeconomic management instrument to adjust the positioning of the economy throughout the cycle, since it must be acknowledged that the current fluctuation bands remain narrow and do not allow for the full benefits of a flexible exchange rate system to be reaped. Morocco can, however, rejoice in its ability to plan such a major economic reform in a gradual manner enabling stakeholders to become familiar with exchange rate fluctuations and forward risk hedging instruments. A number of emerging and developing economies migrated abruptly, under market pressure, to a floating exchange rate regime.

In the absence of a major shock, Morocco can envisage a smooth transition over the next ten years to a managed floating system, preserving the central bank's important role on foreign exchange markets in the event of significant upward or downward pressure on the Dirham. Successful international experiences can inspire the implementation of such a reform. Macroeconomic management failures in Latin America have overshadowed relatively successful macroeconomic management, particularly in Chile, which can serve as a benchmark. The management of mining revenues through the establishment of a sovereign fund to separate public spending from copper prices (Agénor "Budgetary Rules and Sustainability of Public Finances", 2015) is one of many successes in the country's economic policy history, in combination with the reform of exchange rate policy demonstrating sound macroeconomic governance. Between the early 1980s and late 1990s, the country switched from a fixed to a floating exchange rate system, by transitioning via an intermediate exchange rate system often described as innovative in its design. Chile's central bank currently operates within a framework of explicit inflation targeting.

Risks that may undermine a strategy of transition to a managed floating system mainly include upward commodity price movements that may exert pressure on foreign exchange reserves and, to a lesser extent, a sudden halt in FDI inflows. Short-term capital, which often poses macroeconomic management problems in emerging countries, does not represent a major challenge for the Moroccan economy. Historically, these flows remain negligible, due to the narrowness and low liquidity of capital markets on both the equity and private debt sides, protecting the domestic economy from investor arbitrage between domestic and foreign rates of return.